Are emerging economies already engaging with Industry 4.0 technologies?

17 October 2022 Michele Delera, Carlo Pietrobelli, Elisa Calza and Alejandro Lavopa

Photo by Anton Maksimov 5642.su on Unsplash

Article by Michele Delera, UNU-MERIT, Carlo Pietrobelli, UNU-MERIT and University Roma Tre, and Elisa Calza and Alejandro Lavopa, UNIDO

There are many controversies among economists but one fact is undisputed: long-run productivity growth depends on the absorption and deployment of new technologies. Some estimates indicate that differences in technology diffusion account for a quarter of cross-country differences in per capita income. In the midst of a new Industrial Revolution driven by artificial intelligence, machine-to-machine communication, cloud computing and additive manufacturing, countries’ capacity to catch-up will likely depend on the speed with which they absorb these technologies. The implications for emerging economies are profound. New technologies may undermine the viability of labour-intensive development. Yet they may also open up new ways for developing countries to integrate in the global economy.

Are Industry 4.0 technologies already diffusing to lower-income economies? And, if so, what is driving their adoption? In a recent paper, we provide some answers by building on a UNIDO survey of manufacturing firms in Ghana, Thailand and Viet Nam and the whole range of production technologies they employ.

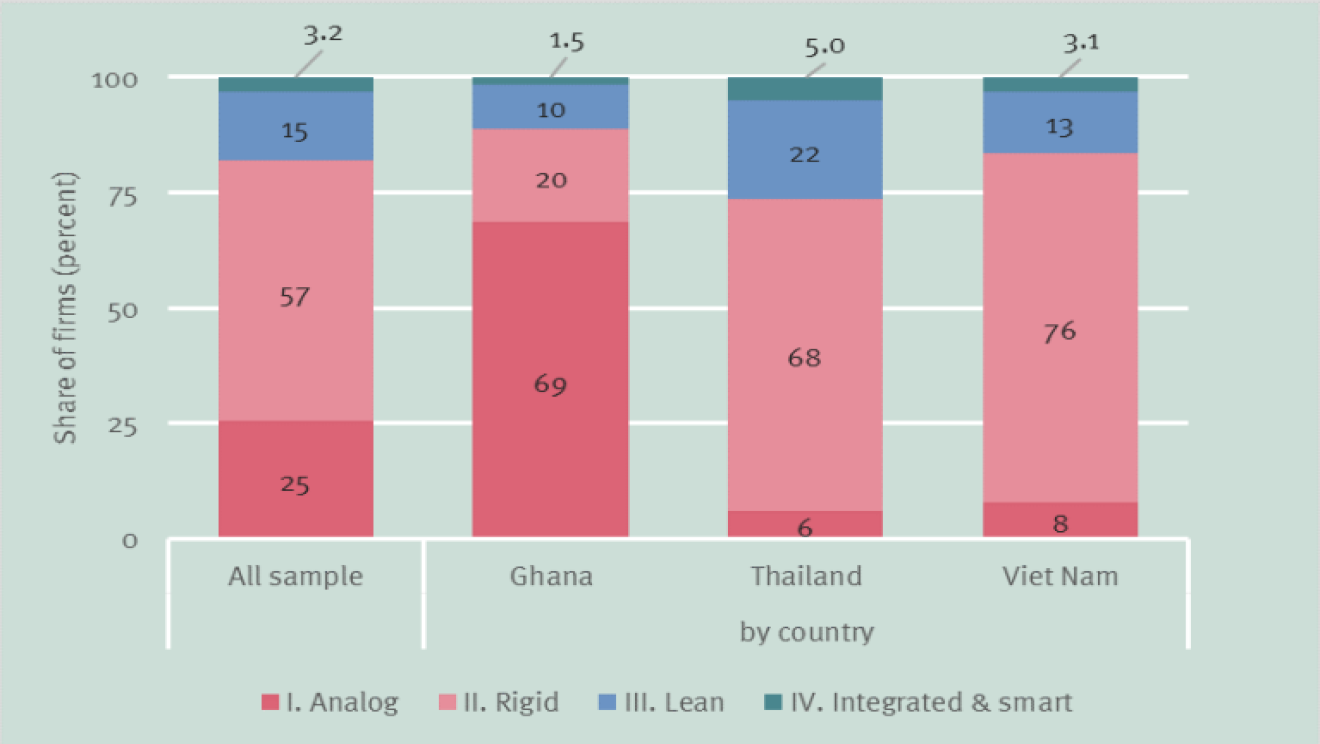

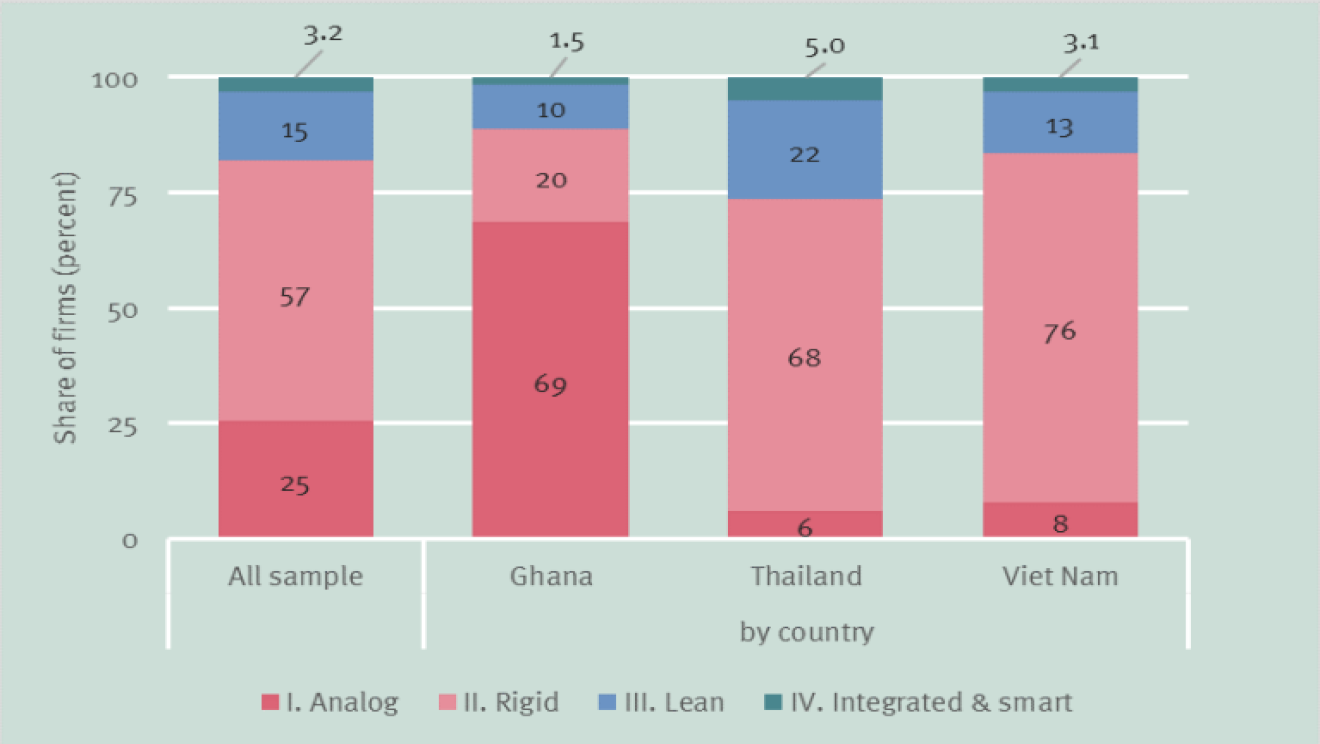

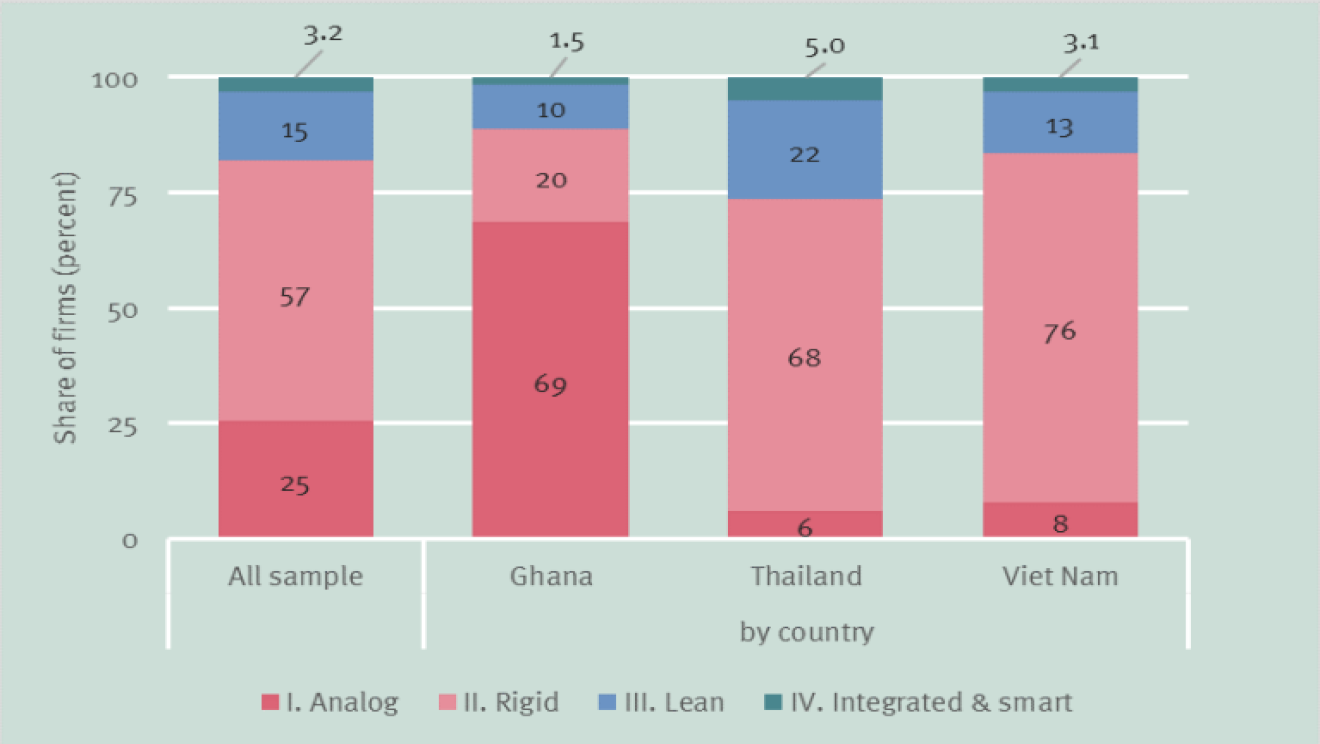

We find large differences across countries, reflecting differences in income levels, economic structure and international integration. The majority of Ghanaian firms in our sample, for instance, tend to employ technologies that would be characterized as analogic (Figure 1). This is in large part related to the country’s industrial structure. According to World Bank estimates, micro, small and medium-sized enterprises account for 80% of employment in Ghana. Informality is also rampant: 90% of firms are not registered. The vast majority of Ghana’s firms thus face significant financial, managerial and knowledge barriers to technology adoption. A weak innovation system compounds these issues.

On the other end of the spectrum, Thailand’s firms appear to be substantially more technologically advanced. Over 25% of Thailand’s firms in our sample use, on average, the latest technologies —those associated with “lean” and “smart” production. Viet Nam is somewhere in between, with a small group of technologically advanced firms coexisting with firms using technologies belonging to a “rigid” mode of production. These cross-country differences also relate to government policy. In recent years, both Vietnam and Thailand have revamped their science, technology and innovation systems to strengthen digital infrastructure and skills.

In all three countries, however, fewer than 4% of firms adopt technologies associated with the Fourth Industrial Revolution (Figure 1). Even in Thailand, only 5% of firms adopt this type of technologies. To the extent that these countries are representative of other economies at similar levels of development, our findings show that Industry 4.0 technology is yet to undergo the process of diffusion in developing and emerging countries.

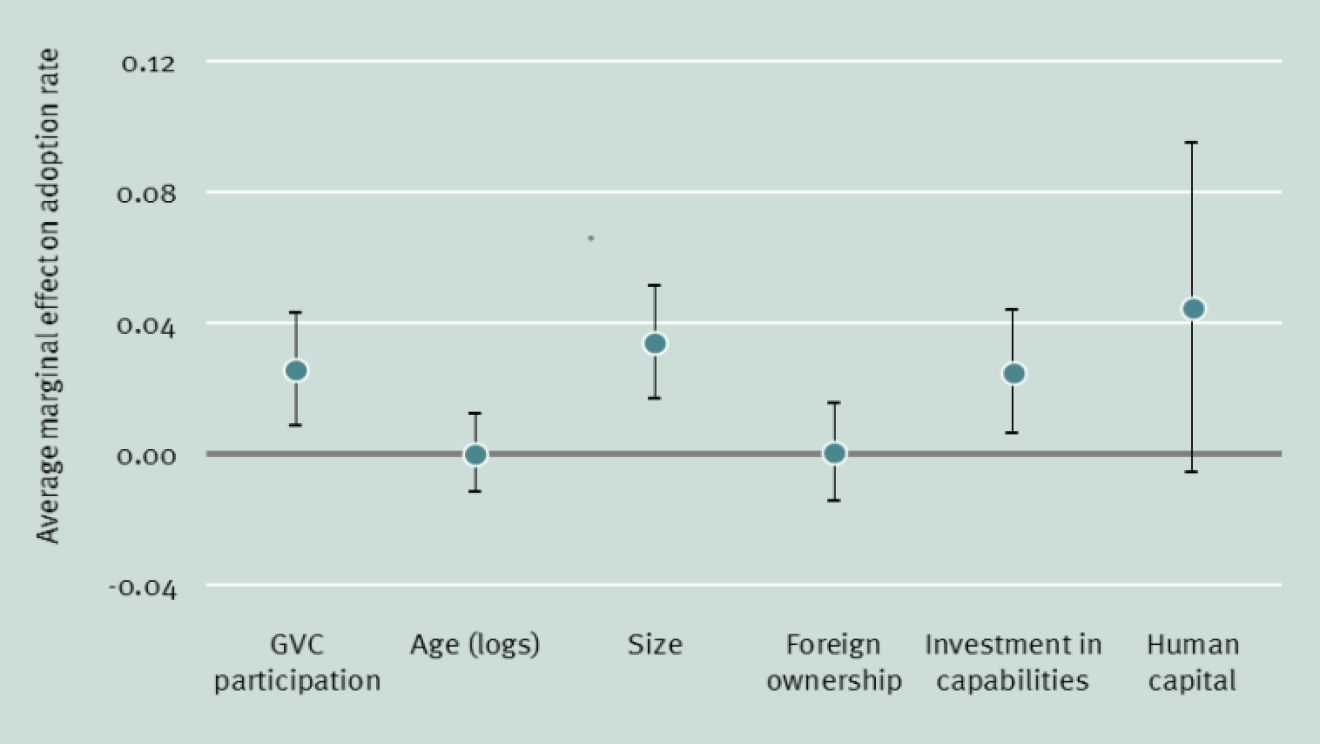

Next, we investigate the firm-level drivers of technology adoption. Building on literature on international trade and technology diffusion, we find that being part of a global value chain is associated with a higher probability of adopting advanced digital production technologies of approximately 2.6 percentage points (Figure 2). Subsidiaries of multinational corporations may more readily gain access to new technologies developed abroad, while suppliers may be pressured by international buyers to upgrade their technology. Our analysis indicates that network effects—whereby firms learn from their suppliers and competitors within their industry and geographical area—contribute to stimulating the uptake of new technologies (but this is not reported in the figure). Firm size and investment in R&D, training and new machinery are also associated with higher rates of digital technology adoption in our sample.

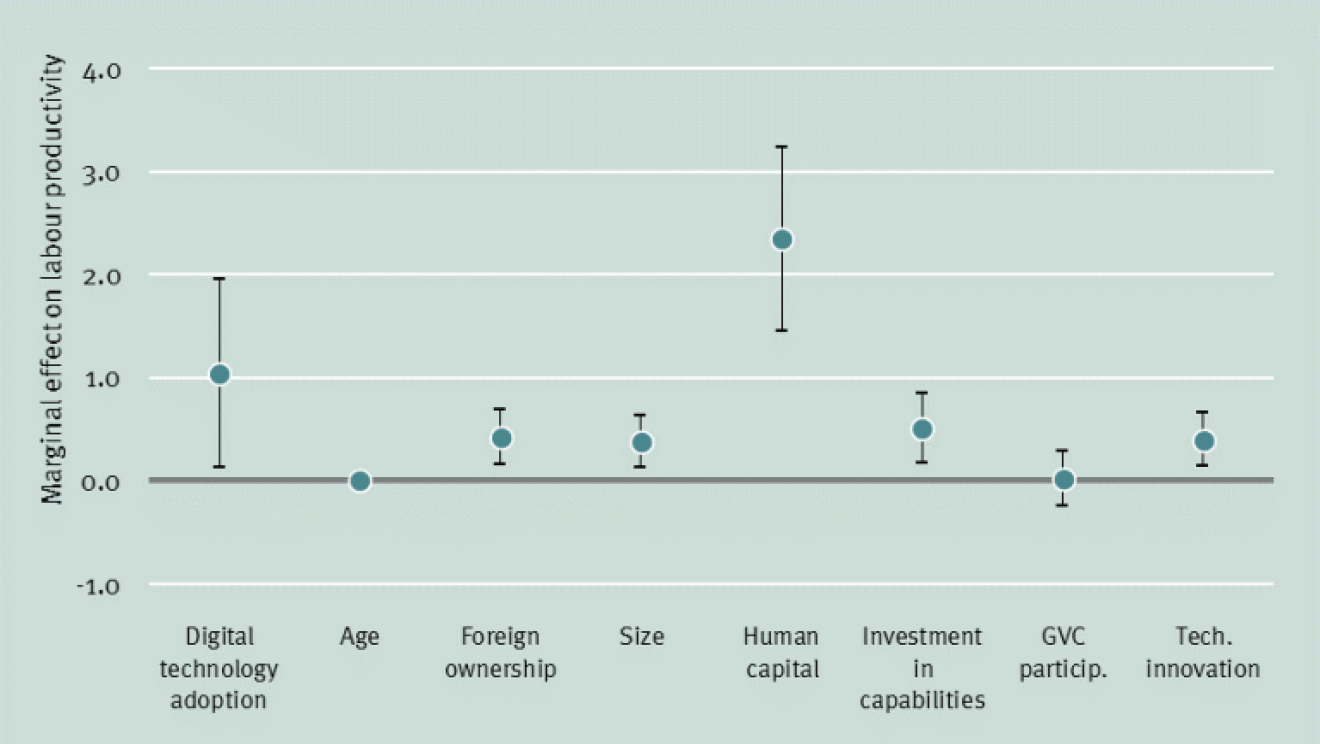

Motivated by the extensive literature on the effects of the adoption of information, communications and technology (ICTs) on firm-level productivity, we also ask whether Industry 4.0 is positively associated with labour productivity in our sample. We find that the adoption of advanced digital technologies is associated with a large, although imprecisely estimated, labour productivity premium (Figure 3). While our findings are consistent across different specifications, including the use of instrumental variables and matching, the cross-sectional nature of our data does not allow us to establish a causal link between technology adoption, firms’ exposure to GVCs and productivity.

In light of these findings, it is clear that greater investment should go into firm-level research into technology adoption in developing and emerging economies —particularly at a time when technological upheaval and the ongoing COVID-19 pandemic threaten to bring about a retrenchment of global trade and investment flows.

- This article was first published by the OECD Development Matters blog and is based on the paper “Does value chain participation facilitate the adoption of Industry 4.0 technologies in developing countries?”.