Coronavirus: the economic impact – 21 October 2020

21 October 2020 the Policy, Research and Statistics Department, UNIDO. This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Andrea Laplane, Jenny Larsen, Alejandro Lavopa and Niki Rodousakis.

By the Policy, Research and Statistics Department, UNIDO. This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Andrea Laplane, Jenny Larsen, Alejandro Lavopa and Niki Rodousakis.

In an environment of high uncertainty and uneven impacts, it remains too early to talk of a real recovery. Comparing production between December 2019 and June 2020 in 62 countries, which together account for around 90 per cent of world manufacturing value added, UNIDO figures show that more than half of those countries experienced a protracted economic downturn over the periods January-March and April-June 2020.

The numbers across the majority of industrial sectors in the first two quarters of the year are similarly gloomy, with transport hit the hardest.

Data show that while the stringency of government measures to contain the spread of the virus had a clear and direct impact on industrial production levels, it does not tell the entire story. The level of economic support policies put in place by governments also played an important role in how certain countries and industrial sectors fared.

As a result, data across countries, regions and industrial sectors vary considerably. Looking ahead, much will depend on individual firms’ capabilities, their degree of market integration, the type of market they serve, as well as government policy responses.

With no end to the health crisis in sight, manufacturing firms will need ongoing financial assistance and support from the state. Evidence shows that governments are switching focus from short-term emergency measures to help firms survive, towards more medium- and long-term policies that seek to prepare industry for the post-COVID “new normal”.

There is currently little consensus on how such policies will be implemented, but we are likely to see a reorganization of global production networks and greater diversification. Many industrialized countries are already moving ahead with efforts to reorient business models, but developing countries continue to experience greater constraints when it comes to finance and technical capacity.

As such, the risks for industrial sectors in developing countries remain high, with potential knock-on effects on economic development. To overcome these challenges, governments need to create incentives to build resilience, for example by introducing measures for reorientation towards sourcing locally, emphasizing domestic supply-chain development and exploring new products and markets.

The impact of COVID-19 on manufacturing

The ramifications of COVID-19 continue to ripple across the world, with the health pandemic triggering the greatest global economic crisis since the 1930s (see July UNIDO COVID-19 bulletin). Countries remain focused on how to respond to the devastating social and economic impacts of the pandemic, which look set to be both profound and protracted. The IMF’s latest World Economic Outlook suggests that the COVID-19 pandemic will cost the world economy $28 trillion in lost output over the next five years while the ILO predicts severe disruption of labour markets for the foreseeable future.

The manufacturing sector has been one of the hardest hit by the downturn. At the outset of the crisis, as supply chains ground to a halt and demand fell sharply, factories either slowed production or closed down their operations. The result was widespread job losses across many industrial sectors or reduced working hours for many employees.

Amid a rising number of COVID-19 cases in many countries and widely varying measures to contain the virus, the outlook for both industry and the economy as a whole remains highly uncertain.

To gain greater insight into the ongoing impact on the manufacturing sector, we analyze the performance of 33 high-income countries, 18 upper middle-income countries, and 11 lower middle- and low-income countries, which together represent around 90 per cent of world manufacturing value added (MVA). [1] The data are based on UNIDO’s seasonally adjusted Index of Industrial Production (IIP), which reflects countries’ volume of production.

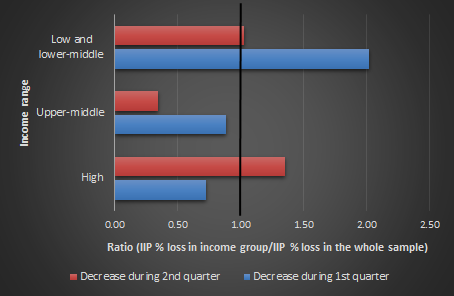

The world industrial production index continues to fall

The IIP for our sample of 62 countries has, on average, continued to fall compared to December 2019, although the overall rate of decline has slowed. The average IIP percentage decrease across countries in March 2020 compared to December 2019 was 5.6 per cent, while the average percentage decrease across countries between March 2020 and June 2020 was 2.5 per cent. As Figure 1 illustrates, the average IIP percentage decrease across lower- and middle-income countries dropped more in the first quarter of 2020 than across the entire sample’s average percentage decrease (ratio higher than 1), but improved in the second quarter of 2020. The average IIP percentage decrease of upper- and middle-income countries was lower than the sample’s overall average percentage decrease in the first two quarters of 2020.

Figure 1. Relative decrease in IIP score.

Note: The bars denote the decline of the corresponding group’s IIP score relative to that of the entire sample. Values above 1 indicate a stronger than average impact of the pandemic on manufacturing.

Source: UNIDO statistics

The majority of countries are facing a protracted economic downturn

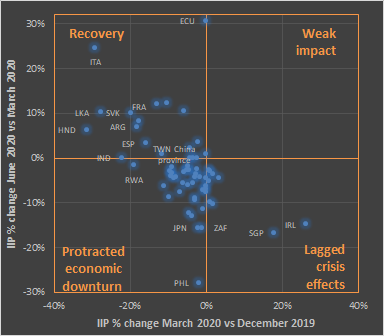

We group the 62 countries into four different categories:

- RECOVERY: countries whose IIP score fell in March 2020 (compared to December 2019), but increased in June 2020 (compared to March 2020);

- PROTRACTED ECONOMIC DOWNTURN: countries whose IIP score decreased in March 2020 (compared to December 2019) and continued to fall in June 2020 (compared to March 2020);

- LAGGED CRISIS EFFECTS: countries whose IIP score increased in March 2020 (compared to December 2019), but decreased in June 2020 (compared to March 2020);

- WEAK IMPACTS: countries whose IIP score climbed in March 2020 (compared to December 2019) and continued to rise in June 2020 (compared to March 2020).

Figure 2 shows that almost 60 per cent of the countries in our sample are experiencing a protracted economic downturn, while only around 20 per cent are recovering. Fifty-five per cent of lower-/upper middle-income countries and 60 per cent of high-income countries are in the PROTRACTED ECONOMIC DOWNTURN group. By contrast, practically no countries have experienced a weak impact: only Taiwan Province of China remained relatively unscathed in the first and second quarters of 2020, while Ecuador’s IIP increased by a remarkable 30 per cent in June 2020 after registering no change in March 2020. The drop in Singapore and Ireland’s IIP scores was mostly concentrated in June 2020, indicating that they experienced lagged effects.

Figure 2. Change of IIP in March 2020 vs December 2019 and in June 2020 vs March 2020.

Source: UNIDO Statistics

Note: Acronyms in the graphs are ITA = Italy, ECU = Ecuador, FRA = France, SVK = Slovakia, LKA = Sri Lanka, ARG = Argentina, HND = Honduras, ESP = Spain, IND = India, TWN China Province = Taiwan Province of China, RWA = Rwanda, ZAF = South Africa, SGP = Singapore, IRL = Ireland, JPN = Japan, PHIL = Philippines

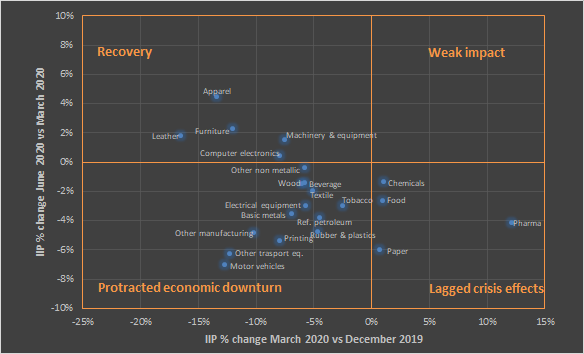

Nearly all industrial sectors are facing a protracted economic downturn, with motor vehicles, leather and other transport equipment being hit particularly hard [2]

We use the sectoral IIP dataset to analyse industries and apply the same categories as for the country sample, namely “PROTRACTED ECONOMIC DOWNTURN”, “RECOVERY”,”WEAK IMPACTS” and “LAGGED CRISIS EFFECTS”. We find that nearly all industrial sectors are facing a protracted economic downturn, in particular motor vehicles and other transport, as already highlighted in a previous UNIDO COVID-19 bulletin. The industrial sectors that experienced only a low impact in March 2020—such as pharmaceuticals and food—registered a decline in June 2020 relative to March 2020. Other industrial sectors severely affected by the pandemic, including leather and wearing apparel, grew in June 2020 compared to March 2020 (RECOVERY).

Figure 3. Change in average IIP scores across countries at sectoral level in March 2020 vs December 2019 and in June 2020 vs March 2020. [3]

Source: UNIDO Statistics

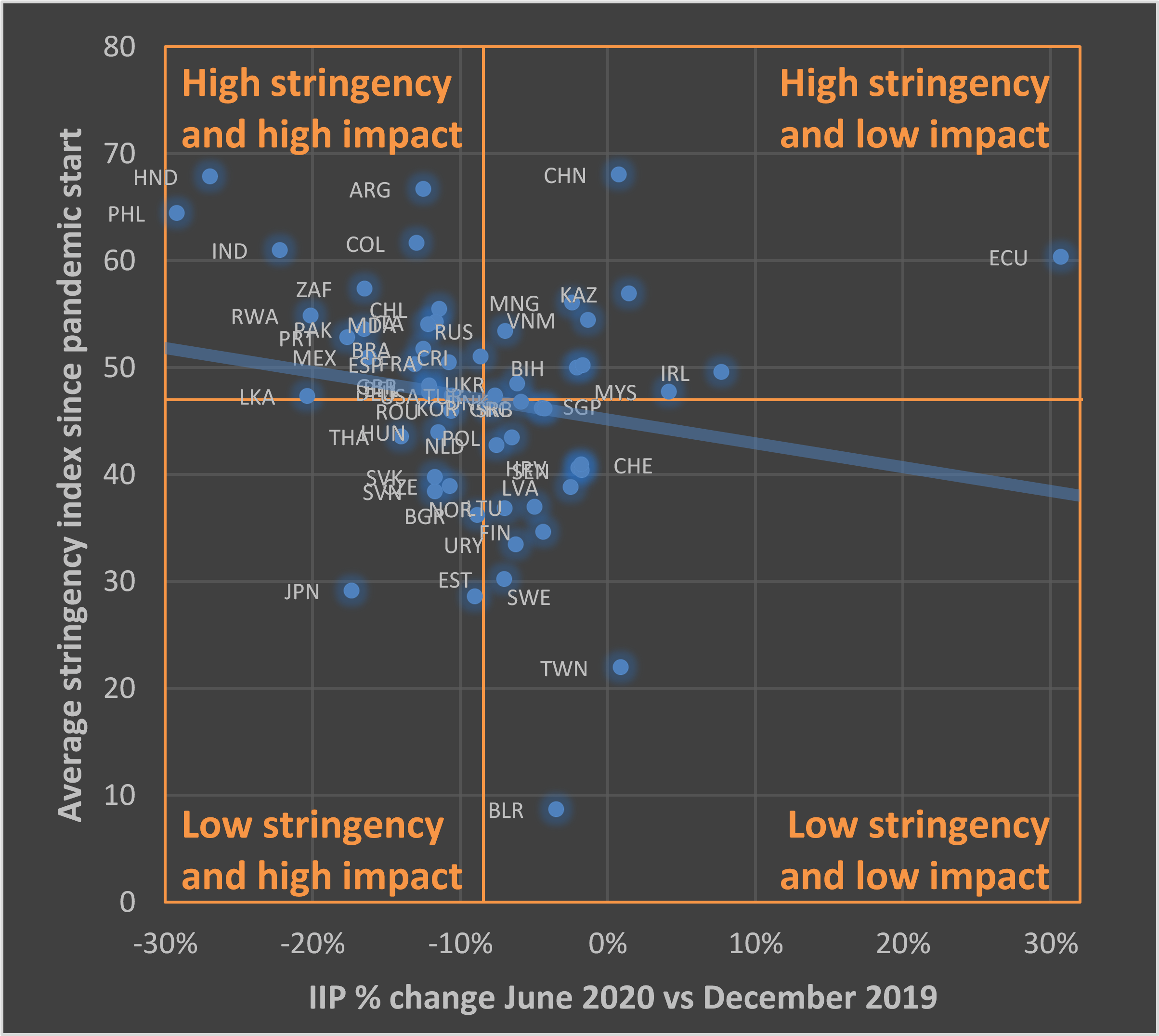

The stringency of COVID-19 containment measures affects the recovery process, but economic support policies make a difference

Using the stringency index introduced by Oxford University reflecting governments’ efforts to contain the pandemic (see Box 1), we find that the IIP score (measured in June 2020 vs December 2019) increases or decreases in proportion to the stringency of the containment measures. Measures such as workplace closings or restrictions on gatherings are likely to reduce industrial production. However, we also find that the IIP score may differ across countries, even when containment measures are equally stringent. This is likely attributable to the effectiveness of the individual countries’ economic support policies (Figure 4).

|

Box 1: The Oxford COVID-19 stringency index

The Oxford COVID-19 Government Response Tracker (OxCGRT) provides a systematic cross-national, cross-temporal measure to demonstrate how government responses have evolved since the outbreak of the pandemic. The stringency index is a composite index of the Oxford Tracker grouping indicators that represent containment and closure policies, including school and workplace closings, the cancellation of public events, restrictions on gatherings, the closure of public transport, stay-at-home requirements, restrictions on internal movement, international travel and border control measures and soft measures, such as awareness campaigns, to help prevent the spread of COVID-19. |

Figure 4. Stringency of containment measures vs change in IIP scores in June 2020 vs December 2019.

Note: The orange lines indicate the average values of the Stringency Index (horizontal line) and the average change in the IIP between June 2020 and December 2019 (vertical line). The blue line provides a linear regression estimate of the relationship between both dimensions.

Source: UNIDO and Oxford COVID-19 Response Tracker

Taking a closer look at firms

Aggregate results ultimately hinge on what happens at firm level

The economic impact of COVID-19 on the industrial sector ultimately depends on how the crisis affects manufacturing firms. The extent of firms’ productive capacities, their degree of integration in domestic and global production networks and the type of market they serve are important factors that determine the extent of the pandemic’s impact on firms. Accordingly, some firms (and countries) are better suited to quickly respond and adapt their operations, thus reducing the shock’s overall effect on their profits, cash flow and staff.

UNIDO survey of Asian firms sheds light on the pandemic’s economic impact

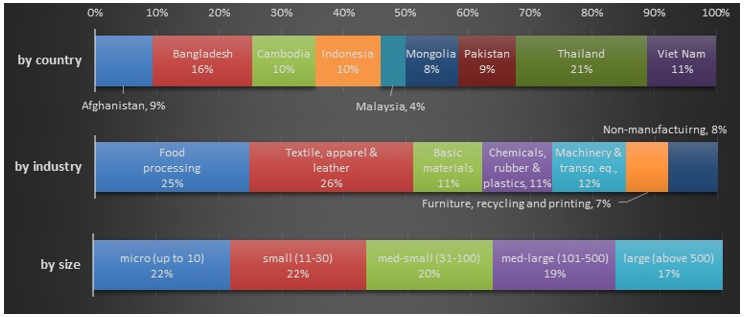

To gain a better understanding of the pandemic’s socioeconomic impact on developing countries, UNIDO conducted a survey of manufacturing firms in nine emerging economies in Asia. The survey was conducted online between April and July 2020 in collaboration with governments, business chambers and other agencies in the participating countries. [4] A total of 1,400 responses were collected. The results obtained provide new insights into the distinct impacts of COVID-19 on countries, industries and firms, as well as into the main responses adopted by governments and firms. Figure 5 summarizes the structure of the responses in terms of country, industry and firm size.

Figure 5. Distribution of sample by country, industry and firm size.

Note: Firm size is defined in terms of number of employees.

Source: UNIDO elaboration based on firm level surveys implemented in Asia.

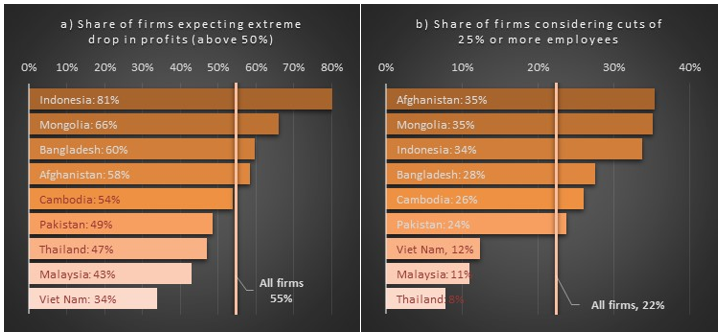

The expected impact on firms’ profits and employment differs across countries

The expected impact on profits and jobs varies considerably across the countries analysed (see Figure 6). On average, over half of the firms surveyed predict a significant fall in profits, and one in five expects massive job cuts. Firms in Indonesia, Mongolia, Bangladesh and Afghanistan are the most pessimistic: the share of firms in those countries anticipating extreme losses in profits and jobs lie above the regional average. A large number of firms in Cambodia and Pakistan also expect record-high layoffs, although they are less pessimistic in terms of profits. Firms in Viet Nam, Malaysia and Thailand tend to be more optimistic in general. The share of firms expecting a sharp decline of both profits and jobs is lower in those countries than the regional average. This is the case, in particular, for employment (see Figure 6, Panel b).

Figure 6. Expected impact of COVID-19 on firms’ profits and employment by country.

Note: Countries according to indicator. Source: UNIDO elaboration based on firm level surveys conducted in Asia.

Differences in containment measures partially explain the cross-country variance in economic impact

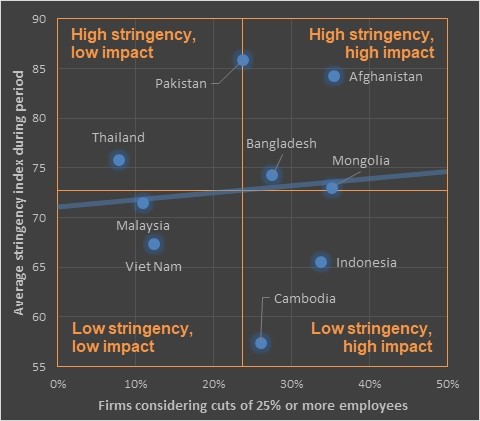

As shown above, the pandemic’s short-term economic impacts on industrial production tend to reflect the stringency of governments’ containment policies. Countries that introduced stricter containment measures also experienced sharper drops in industrial activity. Results at the firm level support this conclusion too. The share of firms anticipating massive layoffs rises with the level of stringency of the country’s containment policies, as captured by Oxford University’s Stringency Index (see Figure 7). [5]

Figure 7. Stringency of containment measures and expected layoffs.

Note: The orange lines indicate the average values of the Stringency Index (horizontal line) and the average share of firms contemplating massive job cuts (vertical line). The blue line provides a linear regression estimate of the relationship between both dimensions.

Source: UNIDO elaboration based on firm-level surveys conducted in Asia and the Oxford COVID-19 Government Response Tracker (OxCGRT).

Stringent containment policies don’t always imply more severe economic impacts

The nine Asian countries analysed can be grouped according to the relative stringency of their containment measures and the expected impact on jobs compared to regional averages. It is assumed that countries that have adopted very stringent measures (e.g. Bangladesh, Mongolia and Afghanistan in Figure 7) will experience massive job cuts, while employment loss in countries with less stringent measures in place is expected to be low (e.g. Malaysia and Viet Nam). Interestingly, some countries have implemented very stringent containment measures but only registered a low impact on jobs (e.g. Thailand and to a lesser extent Pakistan), while countries that adopted less stringent policies recorded high job losses (e.g. Indonesia and Cambodia).

This indicates that containment policies may explain part of the story, but certainly to do not tell the entire story. Other factors clearly play a role in the heterogeneous economic impact the pandemic is having on manufacturing firms across countries. These factors, among others, include countries’ embeddedness in regional or global networks, the capabilities of firms to respond to external shocks and the scope of government support policies.

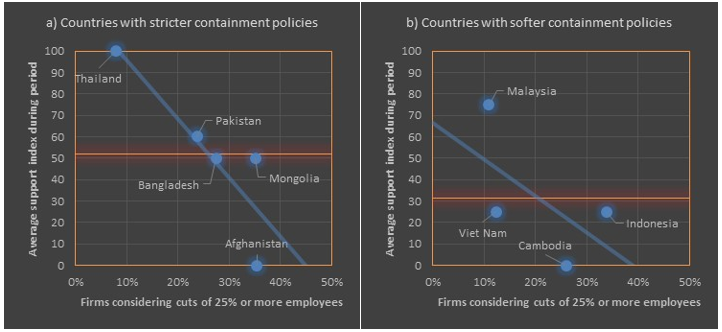

Government support policies can make the difference

One salient feature that distinguishes the countries in the left from the right panel in Figure 7 is the scope of government support policies implemented. Looking at Oxford University’s Index of Economic Support (see Box 2), we find that the governments of those countries expecting the pandemic to have a relatively low impact on employment (e.g. Thailand, Malaysia and Pakistan) have adopted a broader set of support measures than those countries expecting higher job losses. After controlling for the average stringency of the containment measures in place, government support policies seem to play a central role in determining the extent of the pandemic’s impact (see Figure 8).

Figure 8. Controlling for stringency of containment measures, firms in countries with a broad set of government support policies are more optimistic about the future.

Note: Orange lines provide the average values of governments’ economic support index (horizontal line). The blue line provides a linear regression estimate of the relationship between both dimensions.

|

Box 2: The Oxford COVID-19 Index of Economic Support The Index of Economic Support is part of the Oxford COVID-19 response tracker. It is a composite index representing the measures governments have adopted to mitigate the negative impacts of COVID-19 on income. The two sub-indicators of the Economic Support Index are the Income Support Index and the Debt/Contract Relief for Households Index. |

Source: UNIDO elaboration based on firm-level surveys implemented in Asia and the Oxford COVID-19 Government Response Tracker (OxCGRT).

The significance of a diverse policy mix to curb COVID-19’s impact on industry is increasing

To weather the economic downturn caused by COVID-19, manufacturing firms around the globe will need government financial assistance and support. Many governments have already implemented a wide range of policies, including exchange rate adjustments and balance of payment measures, as well as monetary and fiscal policies.

Policy responses to mitigate impacts on industry vary

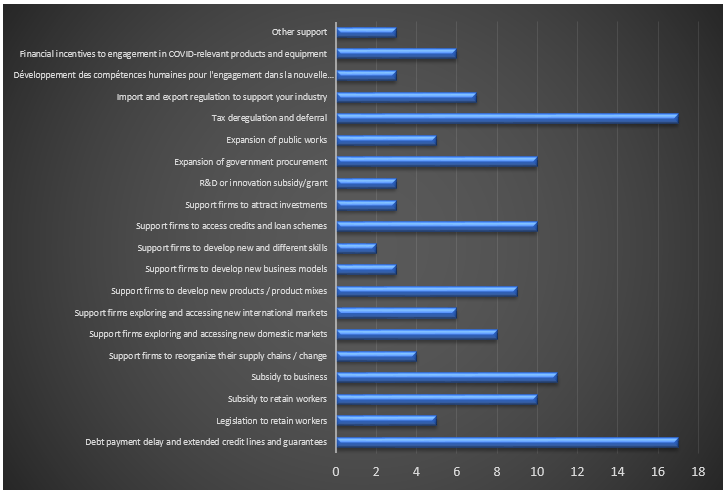

A recent UNIDO survey of policymakers in 20 African countries found that a wide range of policies has been implemented in different countries (see Figure 9). [6] Tax deregulation and deferral as well as debt payment relief measures are among the most frequently mentioned policies.

Figure 9. Policies implemented in African countries to support industries in response to COVID-19.

Source: UNIDO elaboration based on the policymaker survey conducted in Africa.

Policies with a post-COVID perspective are gaining ground

In the first month following the outbreak of the pandemic, governments focused primarily on short-term policy measures to keep businesses afloat during the lockdown, retain employment and support the adaptation of industrial firms to the new realities. Government policies also concentrated on providing quick financial assistance for businesses to address debt and cash flow problems. On the supply side, policy measures ensured continued protection of workers and promoted a rapid rebooting of domestic supply. On the demand side, governments implemented public procurement policies and introduced subsidies for consumption.

Evidence shows that medium- to long-term measures are playing an increasingly important role in the COVID-19 policy mix, with the aim of reorientation of businesses to better prepare them for the ‘new normal’ in the post-COVID world. The underlying rationale is that recovery from this shock will not allow for a return to pre-crisis ’business as usual’.

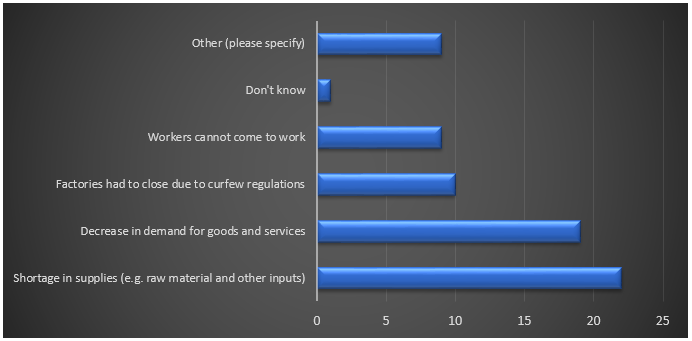

UNIDO’s policymaker survey of African firms corroborates that structural changes in value chains, such as a decrease in demand for goods and services and a shortage of supplies, are expected to have an impact on industrial firms (see Figure 10). Hence, policies to identify alternatives for the organization of global production networks and to build, diversify and reorient productive capabilities will become an important component of strategies to build resilience against similar future disruptions.

Figure 10. Main problems industrial firms face due to COVID-19 (according to policymakers in Africa).

Source: UNIDO elaboration based on the policymaker survey conducted in Africa.

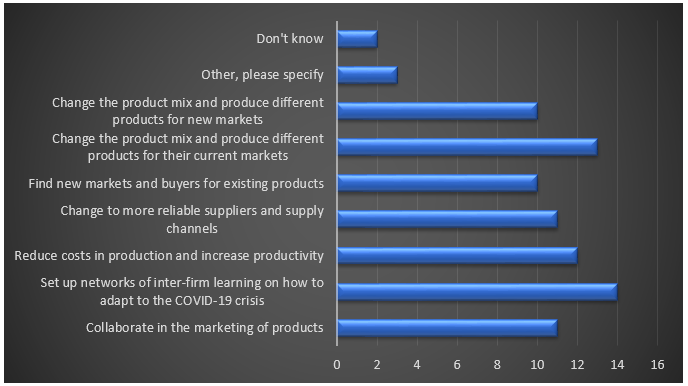

The results of UNIDO’s survey furthermore reveal that policymakers support adaptation of industrial firms’ business models, e.g. by manufacturing new products, identifying new markets, collaborating in marketing and joint learning and increasing their productivity (see Figure 11) to mitigate the impacts of COVID-19.

Figure 11. Measures African policymakers support for industrial firms to mitigate the impacts of COVID-19.

Source: UNIDO elaboration based on the policymaker survey conducted in Africa.

The findings of the policymaker survey are consistent with those of other surveys, such as UEMOA (2020), which concludes that private sector bodies consider government promotion of industrial transformation to be crucial for mitigating the impacts of COVID-19. According to the Union Economique et Monétaire Ouest Africaine (Union économique et monétaire ouest-africaine, UEMOA), such a transformation entails the substitution of imports of products that are more difficult to procure internationally and a shift to exports that are easier to sell on global markets. However, industrial firms in West Africa, in particular, lack the capacity to master such a transformation.

The OECD (2020), based on a survey of small and medium-sized enterprises (SMEs) in OECD countries, concludes that in addition to short-term policy measures such as tax deferrals, debt payment, loan guarantees and direct lending, countries are increasingly adopting structural policies to help firms identify new markets and new sales channels to effectively continue their operations under the prevailing restrictions. These policies aim to reinforce the structural resilience of industrial firms and to foster their growth.

UNIDO’s policymaker survey in Africa reveals capacity constraints in government support for businesses in their efforts to mitigate COVID-19’s impacts. The majority of policymakers interviewed, for example, mentioned that their government faces a number of challenges when it comes to helping companies find new sources of supply and outlets for their products.

Current policies alone will not save industry

According to African policymakers, the policy measures implemented by governments so far will not save industry: 13 out of 18 policymakers surveyed stated that the measures introduced by their government were insufficient, mainly because of the dire budgetary situation of African governments; 16 out of 18 policymakers mentioned that they themselves face severe budgetary constraints when crafting policy measures to support industrial firms. Thirteen out of 20 policymakers also reported that their countries need additional support from international organizations to curb the crisis’ impact.

The limited state budgets in developing countries do not allow for additional expensive debt and cash flow relief measures, and governments are starting to realize that they must develop a new set of policy measures to ensure a smooth post-COVID-19 transition. Sustainable long-term recovery in many developing countries will hinge on measures for business reorientation.

What should these new policy measures look like?

Richer countries are already supporting firms’ efforts to restructure and reorient their businesses. Such policy measures are increasingly moving into the spotlight as short-term measures begin to dwindle due to budgetary constraints, or because traditional business models have started losing viability. McKinsey (2020) calls for a “great reset” to “make big moves fast”, i.e. for businesses to quickly redeploy talent, launch new business models, enhance productivity, develop new products and shift their operations.

Governments should thus focus on conditioning business support to ensure that firms are restructuring accordingly. Germany, for example, is conditioning business support on investments in future technologies to encourage green growth. New Zealand’s refreshed industrial strategy in response to COVID-19 aims to “reset” international education and the tourism industry, to strengthen the resilience of the energy, transport and logistics industries, and to move away from volume to value in the construction, advanced manufacturing and agro industries while strengthening digitalization in all industries.

In addition to cross-cutting economic measures, industry-specific actions need to be introduced for the more severely affected sectors. Such policy measures include support for the development of new business models, the upgrading of technologies, innovation, the exploration of new sources for inputs and the identification of new markets for products. A large part of this support can come in the form of knowledge and technology exchange, but must be matched by credit schemes and investment promotion.

There is limited evidence about which of the short-, medium- and long-term policy measures—be they focused on relief measures or on more structural reorientation—effectively promote industrial development. The economic research community needs to therefore continue evaluating countries’ economic performance based on recent policy reforms. The results of such research will, however, only be available in the medium term.

The post-COVID risks for industries in developing countries are very real and could result in severe setbacks in their performance. In these unprecedented times, business continuity in industry is key. This calls for a prudent response to the supply- and demand-side effects of the COVID-19 aftermath as soon as the containment measures are lifted. To future-proof industry, governments need to implement initiatives that ensure that production can stand on more solid ground in case of supply chain disruptions. This may include reorientation towards sourcing locally, emphasizing domestic supply chain development and the exploration of new products and markets.

[1] According to the World Bank classification, high-income countries are Belgium, Chile, Taiwan province of China, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, the Republic of Korea, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, United States of America and Uruguay. Upper and middle-income countries are Argentina, Belarus, Bosnia and Herzegovina, Brazil, Bulgaria, China, Colombia, Costa Rica, Ecuador, Kazakhstan, Mexico, North Macedonia, the Russian Federation, Serbia, South Africa, Thailand, Turkey. Lower middle-income and low-income countries are Honduras, India, Mongolia, Pakistan, the Philippines, Moldova, Rwanda, Senegal, Sri Lanka, Ukraine, Viet Nam.

[2] Other transport equipment refers to the International Standard Industrial Classification (ISIC) manufacturing sector which includes the building and repair of ships and boats, and the manufacture of railway locomotives and rolling stock, aircraft, spacecraft, motorcycles and bicycles. For more detailed information, please click here.

[3] For each sector, the average IIP score is calculated by considering the number of countries for which data are available. The number of countries with available data varies across industries.

[4] The firm surveys were implemented with the support of the Regional Division of Asia and the Pacific and UNIDO field offices in the respective countries, and were carried out in collaboration with the following partners: Afghanistan: Chamber of Commerce and Industries for Women; Chamber of Industries and Mines; Ministry of Industry and Commerce; Bangladesh: BUILD Bangladesh—non-profit organization created by the Dhaka Chamber of Commerce and Industry (DCCI) in partnership with the Metropolitan Chamber of Commerce and Industry (MCCI) and Chittagong Chamber of Commerce and Industry (CCCI); Cambodia: Ministry of Economy and Finance, Ministry of Industry, Science, Technology and Innovation, The Cambodia Investment Board of the Council for the Development of Cambodia, Garments Manufacturers Association in Cambodia, European Chamber of Commerce in Cambodia, Cambodia’s Rice Federation, Young Entrepreneurs Association of Cambodia, Cambodia Women Entrepreneurs Association, UN Resident Coordinator’s Office, UN Economic Impact Group; Indonesia: Indonesian Chamber of Commerce and Industry, Ministry of Cooperatives and SMEs; Malaysia: Ministry of International Trade and Industry, United Nations Global Compact Malaysia Chapter and Federation of Malaysian Manufacturers; Mongolia: Ministry of Food, Agriculture and Light Industry; Mongolian Association of Leather Industry; Mongolian Wool Textile Association; National Association of Mongolian Agriculture Cooperatives; Mongolian Meat Association; Mongolian Food Industry Association; Pakistan: Ministry of Industries and Production; Small and Medium Enterprise Development Authority (SMEDA); PRGMEA; PFMA; PAPAAM; SIMAP; STAGL; Thailand: Ministry of Industry, Industrial Estate Authority of Thailand and Federation of Thai Industries; Viet Nam: Vietnam Industry Agency, Ministry of Industry and Trade and Agricultural Product Processing and Development Department, Ministry of Agriculture and Rural Development.

[5] In the rest of this section, we assess the economic impact of COVID-19 by looking at the share of firms expecting massive cuts in employment. Similar results are also obtained when looking at expected profits.

[6] The policymaker survey was implemented with the support of UNIDO’s Regional Division of Africa and UNIDO field offices in the respective countries and was carried out in collaboration with government focal points at Ministries of Industry around the continent. Responses were obtained from North Africa as well as from sub-Saharan Africa.

Disclaimer: This brief provides information about a situation that is rapidly evolving. As the circumstances and impacts of the COVID-19 pandemic are continuously changing, the interpretation of the information presented here may also have to be adjusted in terms of relevance, accuracy and completeness. The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).

Original release: “Coronavirus: the economic impact", released on 28 March 2020.

First update: “The catchphrase may be uncertainty, but the losses are real", published on 20 April 2020.

Second update: “Great uncertainty comes at a high cost and negative projections – but there’s some good news", published on 04 May 2020.

Third update: “Which countries and manufacturing sectors are most affected by the COVID-19 crisis? Some early evidence and possible policy responses", published on 26 May 2020.

Fourth update: “A health pandemic or a pandemic for the economy?", published on 10 July 2020.