Coronavirus: the economic impact - 20 April 2020

By the Policy, Research and Statistics Department, UNIDO This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Alejandro Lavopa, Keno Haverkamp, Andrea Laplane, and Niki Rodousakis.

From 20 April 2020.

By the Policy, Research and Statistics Department, UNIDO

This brief is produced by a team consisting of Nicola Cantore (lead), Frank Hartwich, Alejandro Lavopa, Keno Haverkamp, Andrea Laplane, and Niki Rodousakis.

Introduction

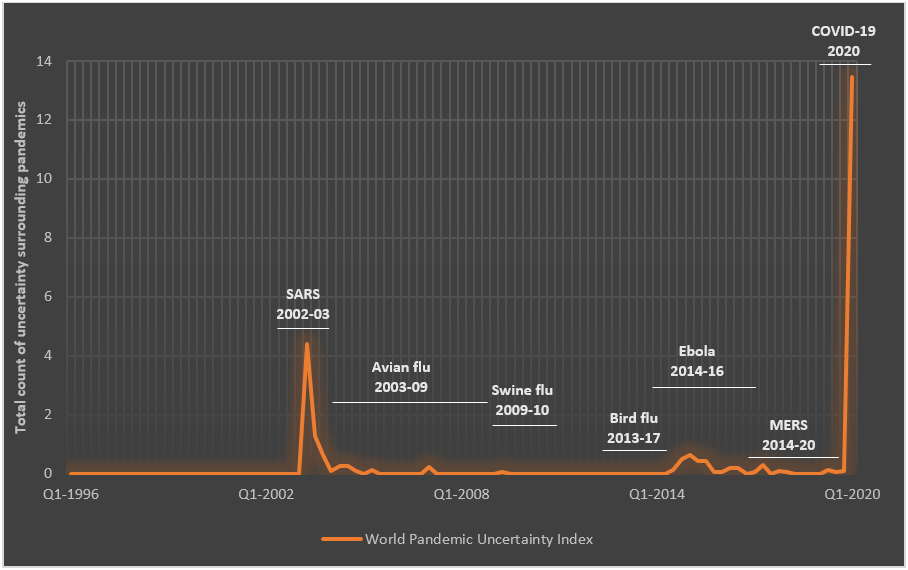

The catchphrase of the COVID-19 crisis, which has engulfed nearly the entire world and carries severe consequences for countries’ populations and economies, is uncertainty. The IMF recently published the World Uncertainty Index for 143 countries from 1996 onwards. The index is constructed by counting the number of times the term ‘uncertainty’ is mentioned in connection with the terms ‘pandemic’ or ‘epidemic’ in the Economist Intelligence Unit (EIU) country reports. The study reveals that the coronavirus is associated with the highest level of uncertainty in the economic context since the index started recording data.

Figure 1: World Uncertainty Index

Source: World Uncertainty Index

This note summarizes the main contributions in recent weeks about the expected impact of COVID-19 on key macro variables such as GDP growth rate, employment, capital and the SDGs; its impact on manufacturing production and the trade of goods; and countries’ possible industrial policy responses to address the impacts of the pandemic.

Impact on macroeconomic variables

Containment measures have led to further downward predictions of world GDP growth

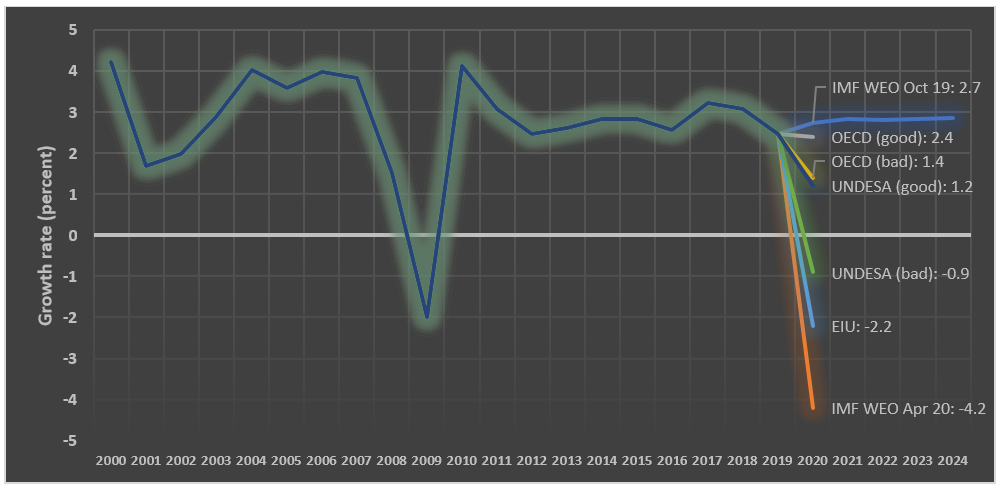

On 14 April, the International Monetary Fund (IMF) updated its global growth projections from only three months ago, indicating that the global economy is expected to experience its worst recession since the Great Depression, surpassing the deep economic slump following the global financial crisis a decade ago. Earlier in April, the United Nations Department of Economic and Social Affairs (UNDESA) analysed the effects of the containment measures and projected that the world economy could, in the worst-case scenario, contract by up to 1 per cent. Similarly, the OECD stated in early March that increasingly stringent lockdown measures in most of the world’s advanced economies would inevitably result in significant declines in GDP growth.

Figure 2: World growth outlook for 2020: latest projections by different organizations

Source: UNIDO elaboration on EIU, IMF, OECD and UNDESA

The impact on employment will be worse than initially expected

The ILO’s previously predicted rise in unemployment of up to 25 million in 2020, with losses in labour income in the range of USD 860 billion to USD 3.4 trillion, seems accurate, if not underestimated. According to the ILO, these numbers may underestimate the real magnitude of COVID-19’s impact. The ILO’s latest summary states that the current containment measures are affecting close to 2.7 billion workers, representing around 81 per cent of the world’s workforce.

Developing countries are expected to suffer the most

The crisis is expected to hit workers in low- and middle-income countries particularly hard, where the share of those working in informal sectors, and who therefore have limited access to adequate health and social protection, is higher. To make matters worse, the expected massive job losses among migrant workers will likely have knock on effects on economies that heavily depend on remittances. Furthermore, the containment measures in advanced economies have already started impacting less developed countries through lower trade and investment.

Capital flight from developing countries at unprecedented rates

The rattling of financial markets, together with tightened liquidity conditions in many countries, have led to unprecedented outflows of capital from developing countries. UNCTAD illustrates the net debt and equity outflows from the main emerging economies, which amounted to USD 59 billion in the month since the COVID-19 crisis went global (21 February to 24 March).

COVID-19 will set back the achievement of the SDGs

The United Nations (UN) has expressed concern that the COVID-19 crisis will lead to a reversal of decades of progress in the fight against poverty, and that already high levels of inequality within and between countries will be further exacerbated. The crisis will therefore inevitably and adversely impact the implementation of the 2030 Agenda for Sustainable Development. The COVID-19 pandemic is expected to negatively influence almost all SDGs. The current crisis will also severely affect the prospects for industrialization in developing countries.

Impact on trade and manufacturing production

COVID-19 is severely impacting manufacturing production in developing countries because: 1) demand from high-income countries for manufacturing goods and raw materials is decreasing; 2) value chains are being disrupted due to delays in the delivery of necessary components and supplies from more technologically advanced countries; 3) other factors, including policies (e.g. restriction of movement of goods and people), inability of employees to reach the workplace or financial constraints, which affect the normal production process. UN economists have estimated a USD 50 billion decrease in manufacturing production in February 2020, and the IMF warns that the negative economic effects will be felt “very intensively” in developing countries that sell raw materials. All these negative channels will inevitably have an impact on exports from developing countries. The losses in export volume will be further intensified by the decline in energy and commodity prices. UNCTAD projects that developing countries as a whole (excluding China) will lose nearly USD 800 billion in terms of export revenue in 2020.

Impacts in Africa

Fully in line with the global economic prospects, a recent report of the African Union (AU) states that “Regardless of the scenario whether optimistic or pessimistic, Covid-19 will have a harmful socioeconomic effect on Africa” (p. 30). Losses related to the fall of the global oil price are estimated at USD 65 billion. Losses amounting to USD 19 billion are expected in Nigeria alone. The crisis will also affect manufacturing firms. According to the AU report, the automotive industry (-44 per cent), airlines (-42 per cent) and energy and basic materials industries (-13 per cent) face even higher losses. MNE perspectives of profits in developing countries have been revised downwards by 16 per cent. This revision amounts to 1 per cent in Africa compared to 18 per cent in Asia, and 6 per cent in Latin America.

Impacts in Latin America

CEPAL estimates a 1.8 per cent contraction in regional gross domestic product (GDP) in Latin America, a 10 per cent increase in unemployment and a rise in the number of people living in poverty to between 35 million and 220 million (of its 620 million inhabitants). The number of those living in extreme poverty could climb from 67.4 million to 90 million. Much of the negative impact could stem from the drop in the price of commodities and food (copper for Chile and Peru, fish meal for Peru, soy for Brazil, Argentina and Uruguay, beef for Uruguay and Argentina, shrimp for Ecuador) and the close trade relations with China, one of the largest buyers of Latin American goods.

Impacts in Asia

The coronavirus first broke out in China. According to the BBC, the country experienced a 13.5 per cent reduction in industrial production in the first two months of 2020. China is the world’s largest exporter and produces one-third of all global manufacturing goods. The newly published Asian Development Bank Outlook 2020, revising the 6 March 2020 update, asserts that China remains the epicentre of the crisis, but developing Asia has only been hit by a 7.7 per cent decrease in industrial production since the beginning of 2020. Countries that are less affected by the virus are India, NIEs and the ASEAN 5; their industrial production continues to show a positive growth rate.

Policy and coping strategies

Leading news outlets such as the Economist or the Financial Times assert that calls urging governments to act fast and boldly have gained increasing support across the political spectrum. According to those same sources, economic policies that until very recently were frowned upon have resurfaced in a number of countries to prevent a complete economic and social breakdown owing to the containment strategies.

Remedy or reform?

One key question the ongoing crisis has sparked is whether the unprecedented economic measures could be transformed into long-lasting ones and whether they could pave the way towards more structural reforms.

In its report, the UN calls for solidarity and widespread cooperation as a means to building more equitable, inclusive and resilient societies that are better prepared to tackle pandemics, climate change and other challenges.

Short- versus medium- and long-term measures

Most policy analyses in the current literature on the COVID-19 pandemic differentiate between short-term targets and medium- to long-term goals. In the former case, the objective is to address the immediate health situation, to protect income-generating opportunities and to safeguard the operation of critical supply chains, i.e. necessities and health supplies. In the latter cases, interventions to cushion the economic fallout emphasize measures to restore supply chains, recover demand and incentivize productive investment.

Economic mitigation policy responses by countries

As the COVID-19 pandemic is rapidly spreading across the globe, most governments in developed and developing countries have deployed some type of policy response to curb the immediate human and economic effects. The IMF (2020), which is monitoring macro-economic policies (distinguishing between exchange rate and balance of payments measures; monetary and macro-financial measures and fiscal measures), has identified major differences across countries in terms of the breadth and scope of economic actions beyond those related to how strict or far-reaching the adopted social distancing and lockdown measures are (if any).

The documented exchange rate adjustments and balance of payment measures can help policymakers in emerging and developing economies balance the difficult challenge of addressing capital flow reversals and commodity shocks.

Policies to support manufacturing

PwC (2020) has mapped a host of challenges for industry in light of the ongoing crisis, including supply chains and the workforce’s global mobility. It identifies policy measures such as extending lines of credit, reducing infrastructure costs, providing short-term funding, lessening the tax burden and providing supply chain support that could assist manufacturers in responding to and anticipating necessary adjustments.

In addition to all of the above-mentioned measures to mitigate the immediate economic downturn associated with the COVID-19 pandemic, governments have also started to extend support to manufacturing companies. Government stimulus packages announced so far are seen as a welcome step to alleviate the immediate economic damage caused by the pandemic, assisting severely hit businesses and promoting job retention.

Disclaimer: The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).