From building back better to building forward: a collaborative approach to tackling industrial water pollution in the post-COVID era

16 February 2022

By Vania Paccagnan, water economist

- This opinion piece is part of a series of articles commissioned by UNIDO's Department of Policy Research and Statistics. The views expressed in this article are those of the author based on his experience and on prior research and do not necessarily reflect the views of UNIDO (read more).

The pandemic has underscored the need to be better prepared and able to cope with systemic crises, such as those related to energy, water and food (Al Saidi and Hussein, 2021). The achievement of Sustainable Development Goal 6 (SDG-6) and its sub-targets [1] is hampered not only by the lack of or by inadequate water supply and sanitation facilities, but also by untreated industrial water effluents. Together with diffuse agricultural pollution and untreated municipal wastewater, industry continues to contribute to the pollution of major rivers around the globe. Industry can therefore play a key role in improving local water security, considering that adequate treatment of municipal and industrial wastewater is a prerequisite for reusing water.

The temporary improvements in aquatic ecosystems following the imposition of lockdowns and restrictions to economic activity were short-lived[2] and did not reverse the long-term environmental degradation caused by past unsustainable production and consumption patterns. Aside from preventing the spread of the virus, sustainable water use is crucial for addressing overlapping shocks (Sadoff and Smith, 2020), as investments in essential infrastructure increases a country’s ability to respond to systemic risks (OECD, 2020). A sustainable and inclusive recovery from the pandemic calls for improvements in water infrastructure, including industrial wastewater treatment facilities, combined with mitigation technologies. The COVID recovery presents an opportunity to align today’s investment decisions with the long-term objectives of increased resilience to climate change (through mitigation and adaptation policies), biodiversity protection and resource efficiency.

From a macroeconomic perspective, investment in green infrastructure is key in driving the transition to a more resilient economy and to avoid locking-in polluting industries. Sustainable industrial water management requires substantial investments by the manufacturing sector—especially in developing and emerging economies—to increase or update firms’ wastewater treatment potential and to facilitate the reuse of wastewater. While the industrial sector demonstrates great heterogeneity in terms of water resource use for productive purposes (compared to municipal water uses, which are based on standard technologies), best practices have emerged for several industries, from food processing to pharmaceuticals. The case for investing in wastewater treatment technologies has recently been reinforced by experiences made with the recovery of materials and power generation through the adoption of most advanced technologies (Process-Net, 2017). Industrial effluents have already become a resource for creating a wide range of high-value products (Guerra-Rodríguez et al., 2020[3]), from chemicals to electronics. While in developed countries existing plants need to be upgraded, in developing ones the latest available technologies and solutions could be applied. The adoption of circular economy approaches by businesses in different industrial sectors offers tremendous untapped cost savings associated with the recovery of materials from industrial sludge (World Bank, 2019).

While economic stimulus packages introduced by governments around the globe in response to the COVID-19 pandemic could boost inclusive green growth (OECD, 2020), appropriate financing and governance approaches need to be developed to drive the transition to more sustainable industrial water use based on a transparent assessment of manufacturing firms’ environmental impacts. Yet many companies lack an

understanding of water sustainability issues, the technical expertise, and the financial resources required to implement sustainable water use practices and technologies (Davis, 2021).[4]

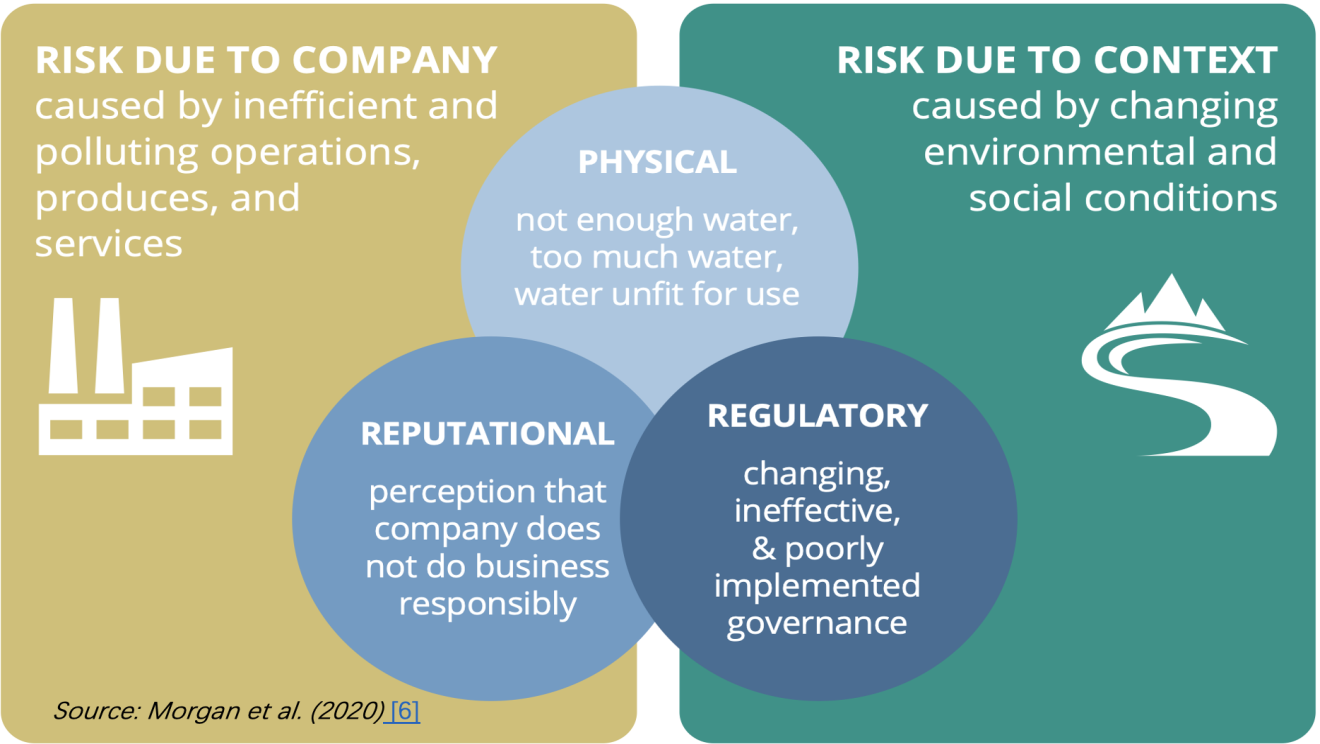

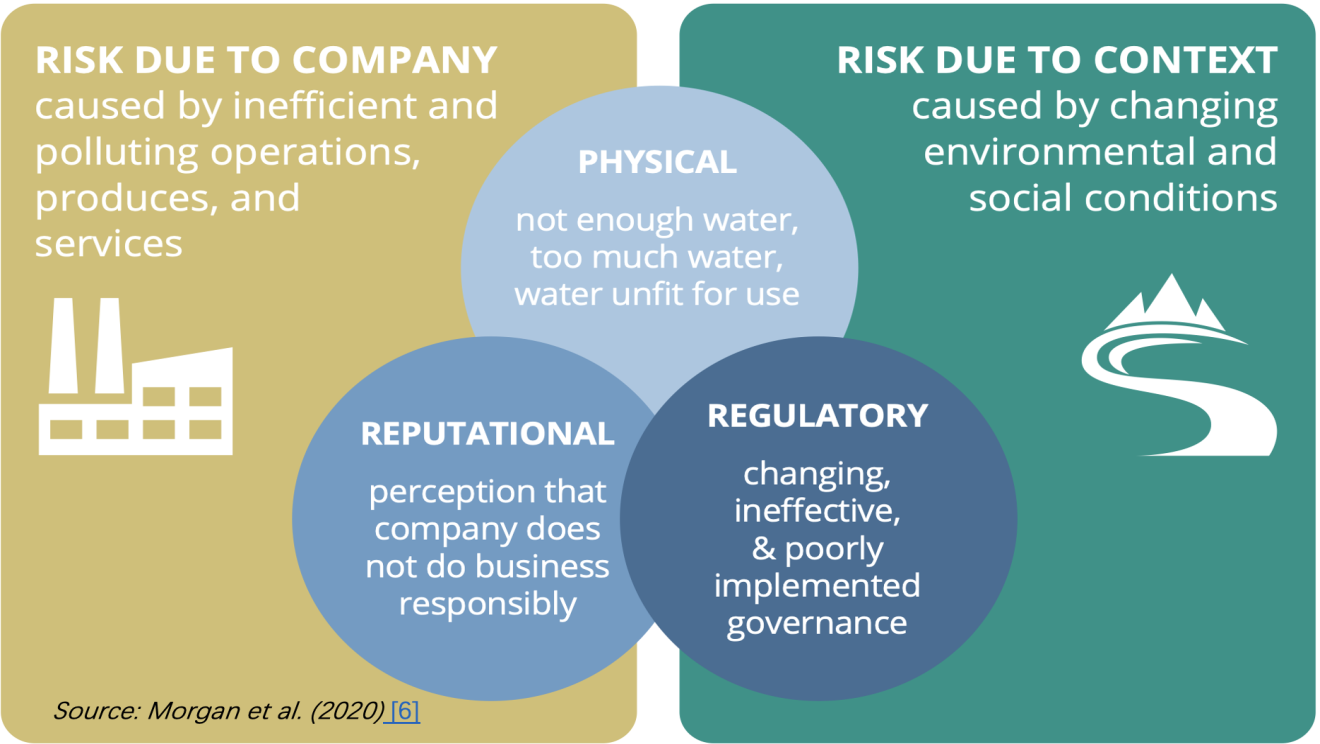

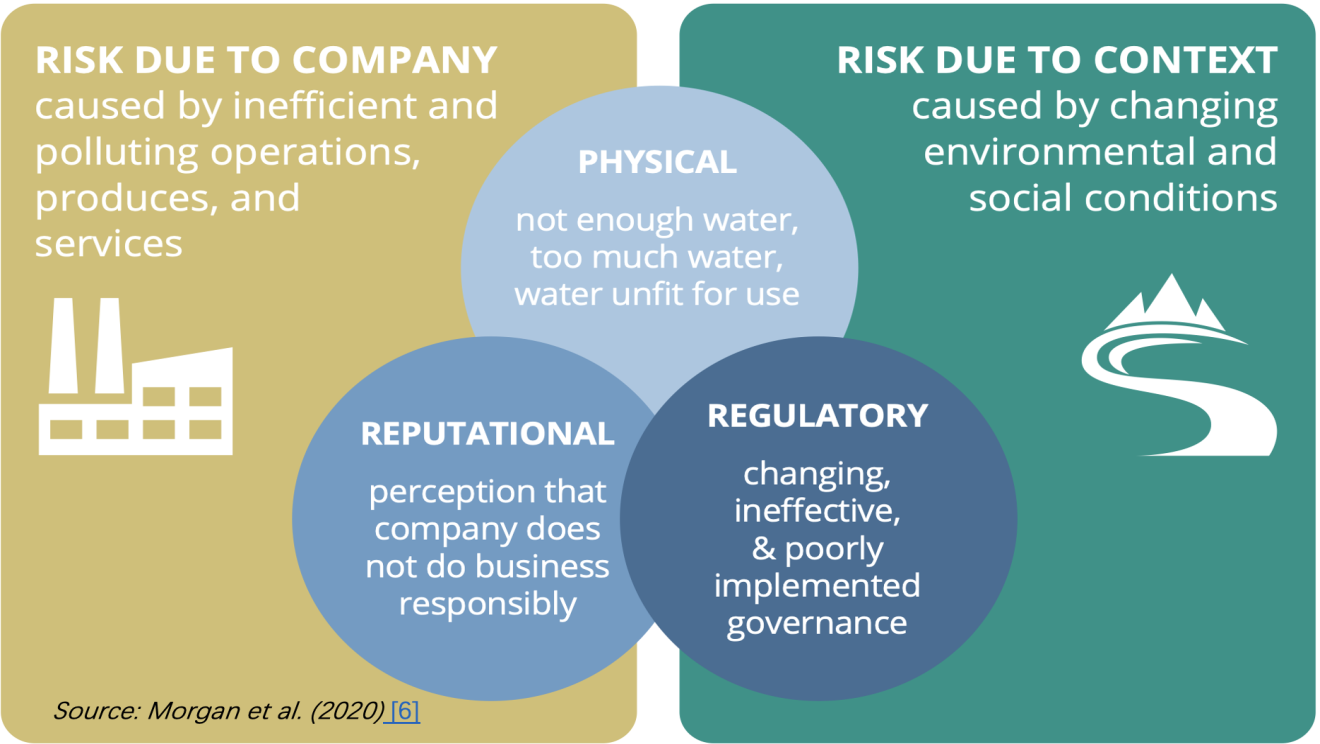

Protecting local water sources to ensure reliable supply is indispensable from a long-term business sustainability perspective. Firms already face a series of water risks [5], either directly (due to changes in local water availability) or indirectly (through disruptions in the value chain caused by drought or flood events). As illustrated in Figure 1, firms’ environmental management strategies can avoid reputational risks (public perception of the firm), and can indirectly influence the physical risks in the context in which they operate and along the value chain by increasing their resilience to water scarcity and flooding (Morgan et al., 2020; CSRD, 2021[1]).

Figure 1 – Water risk framework

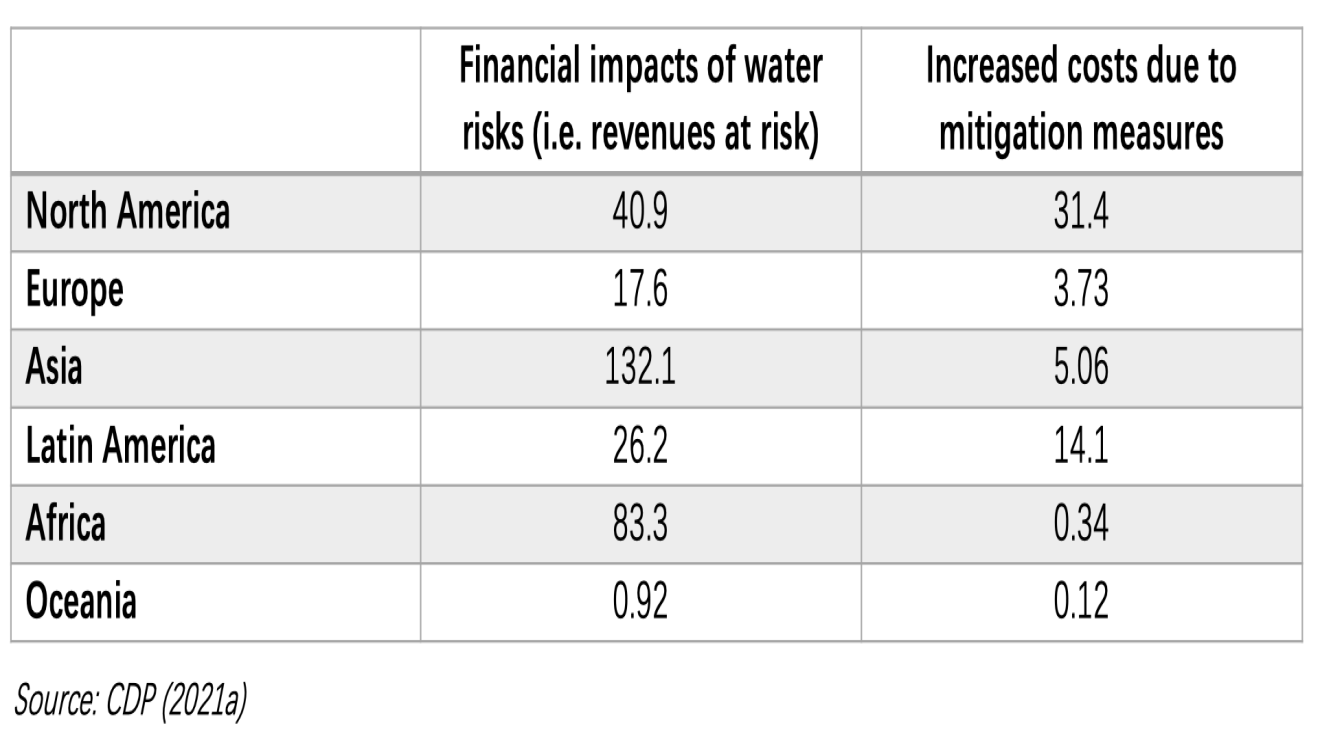

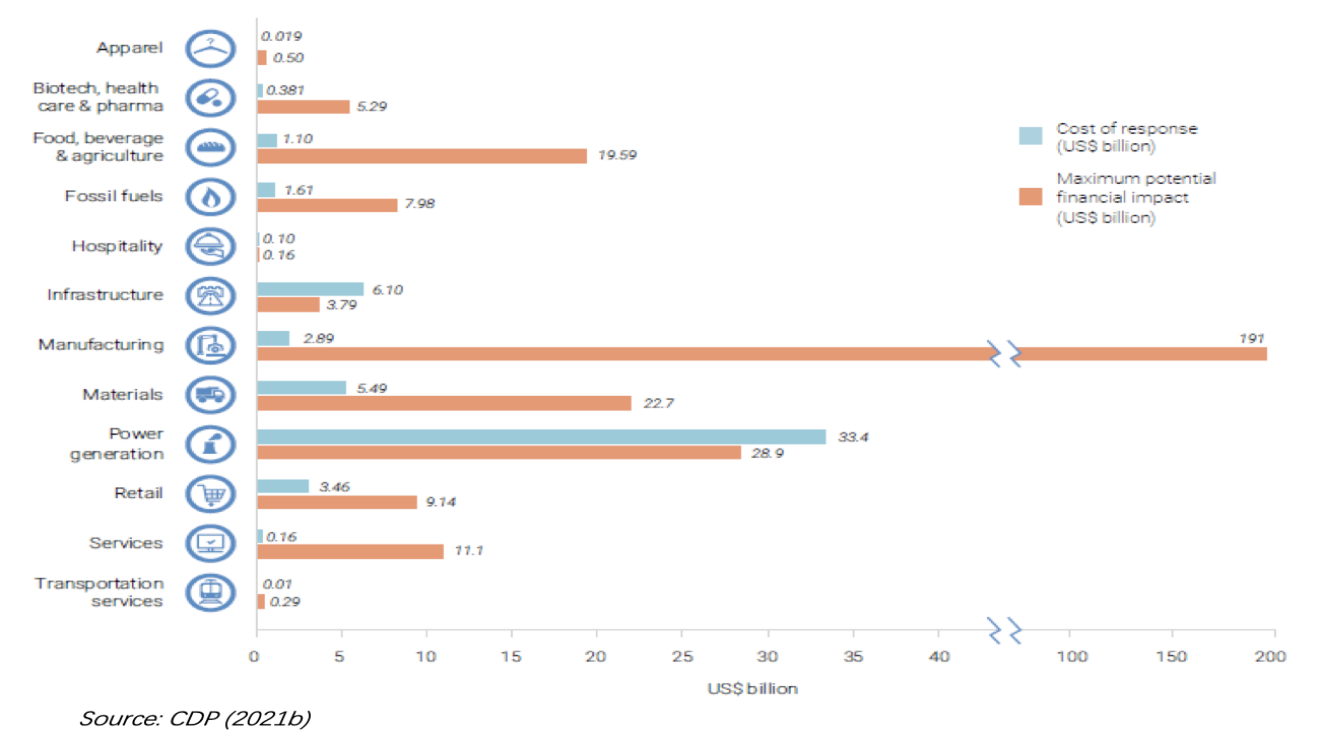

In a recent survey, the CDP [7] concluded that water risk represents one of the biggest challenges for major corporations. As highlighted in Table 2, the potential financial impacts of water risks (i.e. revenues at risk) far exceed the costs of addressing them. The business case for mitigating water-related risk is clear in all continents, and is especially pervasive in Africa and Asia.

Table 2– Financial implications of water risk for major corporations (billions USD)

Figure 2 – Potential financial risk and mitigation cost by industry (2020)

The international community had been engaged in several initiatives well before the outbreak of the pandemic to improve the disclosure of companies’ non-financial information on the premise that increasing awareness and the understanding of climate-related risks, including water scarcity or flood risk, is essential for ensuring the economic system’s financial stability and for redirecting private investment towards green projects. In 2017, the European Commission’s Task Force on Climate-related Financial Disclosures recommended financial institutions and other (non-financial) firms to disclose information on climate-related risks and opportunities[8], recognizing that these could affect companies’ financial performance. This concept was further developed in the Non-financial Reporting Directive (NFRD), which introduces the “double materiality” perspective (Adams et al., 2020; Bussot et al., 2021). Accordingly, companies should report how sustainability issues affect their performance, position and development, and how their activities, in turn, impact society and the environment. The European Commission’s recent proposal for a revised Corporate Sustainability Reporting Directive (CSRD)[9] reaffirms this requirement for large

companies. Whilst European regulations will apply to companies located in Europe, their effects will be felt beyond the continent’s borders, as sustainability reporting has an impact along the entire value chain, both upstream and downstream. Several cross-sectoral examples exist of global buyers and finance providers that implemented programmes for financing sustainable supply chains and to assist local SMEs in adopting sustainable water management practices (Bancilhon et al, 2018[10]; Maennicke and Honerhoff, 2021[11]).

The impacts of business activities on risks and resilience are often not adequately reflected in firms’ strategies or evaluations, but recent policy developments could change general business reporting practices. On the one hand, information on a firm’s sustainability allows asset managers to assess investment risk in terms of the target firm’s performance, position and potential development, and to flag the impact of the firm’s activities on society and the environment, on the other. An analysis by Ching and Yi (2020) of companies involved in water-related business activities[12] concludes that they benefit from higher risk-adjusted returns over the long term than the global equity market in general. Climate- and water-related risks can be transformed into opportunities, not only for companies that offer products and services related to climate change mitigation and adaptation, but also for those that are threatened by these risks. Improvements in environmental management systems brings co-benefits such as more resource efficient productive processes (and consequent operational cost savings), as well as wider societal benefits (e.g. reduction of health impacts from pollution). In this respect, better and more integrated sustainability reporting at firm level could positively influence business strategies and improve relationships with local stakeholders by highlighting the positive impacts the manufacturing firm can have at the local level.

Recognizing the positive contribution of manufacturing firms to the protection of local water sources could help reverse chronic underinvestment in water resource protection and fill the financing gap to achieve the related SDGs.[13] Private finance has not yet become a viable alternative to publicly financed programmes, despite the fact that the business case for investing in water infrastructure is clear and compelling. In cases of water scarcity, any measures that increase local water security entail social benefits that are neither captured in market transactions nor in regulations, as the price paid for such measures mostly reflects cost considerations as opposed to their intrinsic value (WWDR, 2021). A mechanism to reward manufacturers for the positive impacts (co-benefits) they produce for local ecosystems through sustainable water resource management must therefore be introduced. The adoption of a double-materiality perspective would be the first step towards internalizing the positive external effects of regulatory (e.g. water fees) and market instruments (e.g. better access to credit and lower interest rates).

Transparency and accountability are prerequisites for attracting private investment. First, “if the market for green investments is to be credible, investors need to know about the sustainability impact of the companies in which they invest”.[14] Better reporting would thus be necessary to access private investments for wastewater treatment and to put businesses in a better position to access public funds with conditionality clauses. Secondly, stakeholder engagement would disclose impacts to manufacturers that they are not even aware of, thereby enhancing firms’ understanding of the impacts their activity has on the local environment. Such collaboration could help overcome the information asymmetry on firms’ social and environment impacts that have not yet materialized.

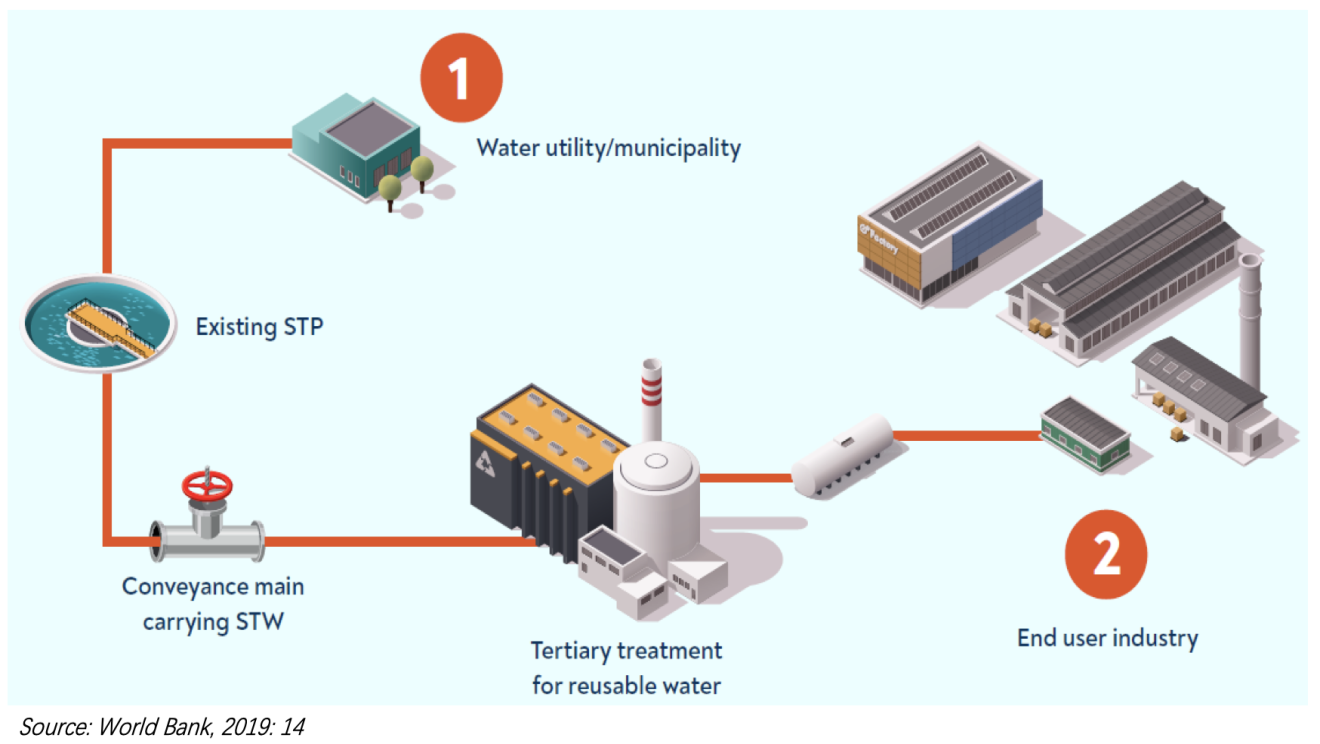

The industrial sector can become a key player in sustainable water management in the post-COVID era, provided that current barriers to investment in wastewater treatment are overcome. The shift towards a circular approach (which, among others, implies economies of scale, resource recovery and energy savings) encourages businesses to work together. By demonstrating how sustainable practices maximize local co-benefits, manufacturers could improve relationships with other stakeholders, to collaboratively pursue sustainability objectives. Recovery from the pandemic represents a major opportunity to not only “build back better” but to “build forward” by experimenting with innovative cooperation between manufacturers and other stakeholders at the local level. One example is the so-called end-user public-private partnership (PPP) model (Figure 3). Although the grey water comes from the effluents of the municipality in the figure, the model could be expanded to include the manufacturing firm’s own effluents by building an additional conveyance main that leads to the treatment plant. The manufacturing firm could co- or fully finance the conveyance facility and wastewater treatment plant. Another possibility would be for the manufacturing firm to supply bulk-treated wastewater to local farmers. Local circumstances will determine the preferred PPP model structure, and the financial arrangements will vary according to the selected PPP type (World Bank, 2019). Several existing institutional arrangements are described in Delgado et al. (2021)[15].

Figure 3– Diagram of the end-user reuse model

By joining forces and pooling water supply and treatment needs at the local level, the “critical mass” necessary to access new sources of finance can be achieved, even for smaller projects, which often face difficulties in terms of access to capital markets. If a portfolio approach is adopted, such projects can be aggregated at the local or regional scale, reducing the transaction costs related to project appraisal and approval. Finally, aggregating projects diversifies the risk from an investor perspective, thus making more favourable financing conditions possible. The portfolio approach should be applied at the catchment scale to ensure that all external effects are taken into account. Economies of scale could be exploited by co-developing centralized municipal-industrial treatment facilities as illustrated above. In this respect, successful case studies from industrialized countries could be replicated in least developed countries with support from international organizations, including UNIDO, e.g. through existing eco-industrial parks. This calls for leadership at the local level, a role that bigger industrial water users could take on.

- It is now abundantly clear that the COVID-19 pandemic has had an impact on nearly all aspects of our lives and has caused us to rethink “business as usual”. As we adapt to the "new normal", appropriately channeled opportunities can help us improve the way we do business and the way we live. The United Nations Industrial Development Organization's latest flagship report, the Industrial Development Report 2022, provides a comprehensive assessment of the pandemic’s impact on global manufacturing and the prospects for the future of industrialization in a post-pandemic world. The report makes a key contribution to countries' national and international strategies for an inclusive, sustainable and resilient industrial recovery to build back better from the COVID-19 pandemic.

[1] 6.1: Access to safe and affordable drinking water, 6.2: access to adequate and equitable sanitation and hygiene, 6.3: improve water quality, 6.4: address water scarcity, 6.5: implement integrated water resources management, and 6.6: protect and restore water-related ecosystems.

[2] The water quality of rivers and coastal areas improved temporarily as a consequence of the decreases in economic activity during the pandemic, including industrial production (OECD, 2020). Evidence for industrial water pollution is anecdotal[2], but local improvements in the concentrations of NO3, As, Fe, Pb, Se and suspended particular matters are consistently mentioned. Moreover, according to the IFC (2020), industrial water demand decreased by 27 per cent during the lockdowns.

[3] Towards the Implementation of Circular Economy in the Wastewater Sector: Challenges and Opportunities. Water 2020, 12(5).

[4] Chapter 16 in Davis C., and E. Rosenblum, 2021, Sustainable Industrial Water Use: Perspective, Incentives, and Tools. Available at https://iwaponline.com/ebooks/book/814/Sustainable-Industrial-Water-Use-Perspectives

[5] According to the WWF (2009), physical risk relates to situations in which there is either insufficient water (water scarcity or drought), too much water (flooding) or where the water is unfit for the relevant purpose (polluted). Financial risk is caused by the inflation effects induced by water scarcity, which increases the cost of water provision and energy. Regulatory risk arises when changes in legislation affect business operating costs or when new capital investments become necessary. Reputational risk refers to public perception of the company’s operations, which may entail losing market share or customers.

[6] Morgan A., (2020), Right tool for the job. Tools and Approaches for Companies and Investors to Assess Water Risks and Shares Water Challenges. Available at: https://wwfint.awsassets.panda.org/downloads/right_tool_for_the_job_1.pdf

[7] CDP, 2021b, A wave of change. The role of companies in securing a water secure world. Available at: https://cdn.cdp.net/cdp-production/cms/reports/documents/000/005/577/original/CDP_Water_analysis_report_2020.pdf?1617987510

[8] https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf

[9] https://ec.europa.eu/info/publications/210421-sustainable-finance-communication_en#csrd

[12] The paper considers water utilities, water infrastructure providers and suppliers of equipment, technologies and services s for the treatment, separation or purification of water.

[13] Whilst the international community has in recent years pushed for more extended use of blended finance[4] to resolve water management issues (WEF, 2021)[4], only 1 per cent of commercial finance targeted water and sanitation goals between 2012–17 (OECD, 2019).

[14] https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_1806

Adam C., A., Alhamood, X. He, J. Tian, L. Wang, Y. Wang, 20l. The double-materiality concept. Application and issues. Published by the Global Reporting Initiative. Available https://www.globalreporting.org/media/jrbntbyv/griwhitepaper-publications.pdf

Al Saidi and Hussein,2021. The water-energy-food nexus and COVID-19: Towards a systematization of impacts and responses. Science of the Total Environment. Available online: https://reader.elsevier.com/reader/sd/pii/S0048969721015977?token=9962113C95E0DC21CAA0B1181824893756589F5AC5076679EA80F095F6AE520DECD711584AB19223BCE936C675099806&originRegion=eu-west-1&originCreation=20210625105130

Bancilhon, C., Christoph K., and T. Norton, 2018. “Win-Win-Win: The Sustainable Supply Chain Finance Opportunity.” Report. BSR, Paris.

Bossut M., I. Jürgens, T. Pioch, F. Schiemann, T. Spandel, and R. Tietmeyer, 2021. What information is relevant for sustainability reporting? The concept of materiality and the EU Corporate Sustainability Reporting Directive. Sustainable Finance Research Platform. Policy Brief – 7/2021. Available at:

CDP, 2021a. Transparency to Transformation. A chain report. CDP Global Supply Chain Report 2020. Available at: https://6fefcbb86e61af1b2fc4-c70d8ead6ced550b4d987d7c03fcdd1d.ssl.cf3.rackcdn.com/cms/reports/documents/000/005/554/original/CDP_SC_Report_2020.pdf?1614160765

CDP, 2021b. A wave of change. The role of companies in securing a water secure world. Available at: https://6fefcbb86e61af1b2fc4-c70d8ead6ced550b4d987d7c03fcdd1d.ssl.cf3.rackcdn.com/cms/reports/documents/000/005/577/original/CDP_Water_analysis_report_2020.pdf?1614347489

Chakraborty C., S. Roy, S. Sharma, and T. A. Tran, 2021. Aftermath of Industrial Pollution, Post COVID-19 Quarantine on Environment, The Impact of the COVID-19 Pandemic on Green Societies. 2021 Mar 23 : 141–167. Available at: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7984822/

Ching and Yi, 2020. Investing in Water for a Sustainable Future. Available https://www.spglobal.com/spdji/en/documents/education/education-investing-in-water-for-a-sustainable-future.pdf

Davis C., and E. Rosenblum, 2021. Sustainable Industrial Water Use: Perspective, Incentives, and Tools.Available at https://iwaponline.com/ebooks/book/814/Sustainable-Industrial-Water-Use-Perspectives

Delgado, A., D. J. Rodriguez, C. A. Amadei and M. Makino, 2021. "Water in Circular Economy and Resilience (WICER).” World Bank, Washington, DC. Available at: https://www.worldbank.org/en/topic/water/publication/wicer

EC, 2019. Communication from the Commission. C(2019) 4490 final. Guidelines on non-financial reporting: Supplement on reporting climate-related information. Available https://ec.europa.eu/finance/docs/policy/190618-climate-related-information-reporting-guidelines_en.pdf

Fonseca L.M., J.P. Domingues and A. M. Dima, 2020. Mapping the Sustainable Development Goals Relationships. Sustainability. Available at:

Hutton G., Varughese M.C.,2016. The costs of meeting the 2030 sustainable development goal targets on drinking water, sanitation, and hygiene, The World Bank.

Morgan A., 2020. Right tool for the job. Tools and Approaches for Companies and Investors to Assess Water Risks and Shares Water Challenges. Available at: https://wwfint.awsassets.panda.org/downloads/right_tool_for_the_job_1.pdf

OECD, 2018. Financing Water. Investing in Sustainable Growth. Policy Perspectives. Environment Policy Paper no. 11. Available online.

OECD, 2020a. Developing Sustainable Finance Definitions and Taxonomies. Available online.

OECD, 2020b. “Green Infrastructure in the Decade for Delivery – Assessing Institutional Investment” . OECD Publishing, Paris, Available online.

World Bank,2016,, High and Dry: Climate Change, Water and the Economy, World Bank, Washington, DC. License: Creative Commons Attribution CC BY 3.0 IGO. Available at: https://www.worldbank.org/en/topic/water/publication/high-and-dry-climate-change-water-and-the-economy

World Bank, 2019. From Waste to Resource: Shifting paradigms for smarter wastewater interventions in Latin America and the Caribbean. Background Paper V: Financial incentives for the development of resource recovery projects in wastewater. Available at: https://documents1.worldbank.org/curated/en/420981582254775447/pdf/Background-Paper-V-Financial-Incentives-for-the-Development-of-Resource-Recovery-Projects-in-Wastewater.pdf WWAP, 2017. The United Nations World Water Development Report 2017: Wastewater, the untapped resource. United Nations World Water Assessment Programme (WWAP). Paris, United Nations Educational, Scientific and Cultural Organization.

WWAP, 2021. The United Nations World Water Development Report 2021, Valuing water. Available http://www.unesco.org/reports/wwdr/2021/en

UNESCAP (2019). Tackling Industrial Water Pollution. Lessons from China. Available at: https://www.unescap.org/sites/default/d8files/knowledge-products/Tackling%20Industrial%20Water%20Pollution_Policy%20Brief_2019_1.pdf