Outlook for Asian firms gloomy amid severe COVID-19 economic impacts

23 July 2020 Jenny Larsen and Nicola Cantore

by Jenny Larsen and Nicola Cantore

A new report on the economic impact of the COVID-19 crisis by the United Nations Industrial Development Organization (UNIDO) shows pessimism about business prospects in several Asian economies, with more job cuts expected as falling demand hits profits. But impacts across firms and countries vary widely, showing the importance of urgent policy responses from governments.

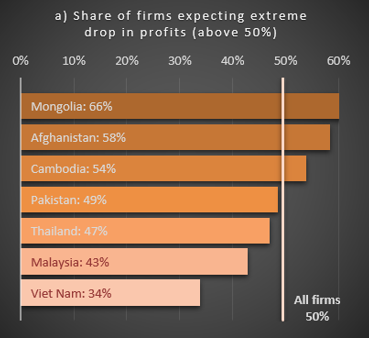

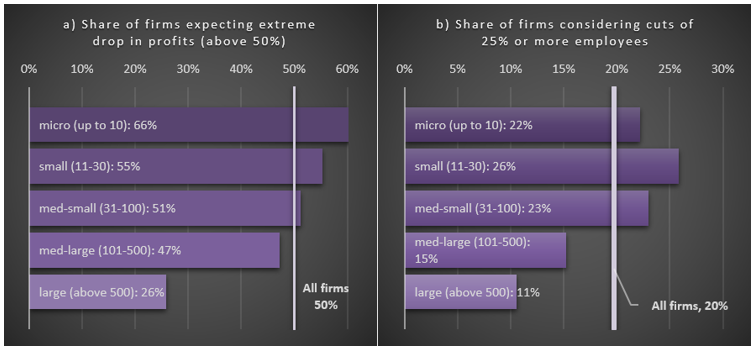

A new online survey of 1,000 firms in seven emerging economies in Asia*, conducted between mid-April and mid-June, shows that half of firms surveyed expect a drastic decline in company profits (50 per cent or higher) in 2020.

Note: The expected impact of COVID-19 on firms’ profits by country

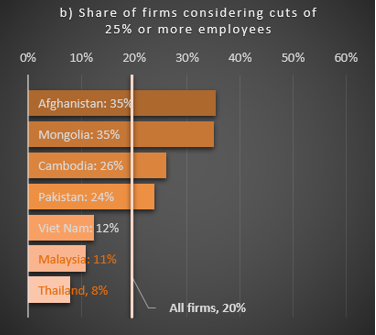

On top of that, 20 per cent of firms stated that they had to lay off employees or are planning to cut one quarter or more of their staff.

Note: The expected impact of COVID-19 on firms’ employment by country

The countries with the largest share of firms expecting massive cuts both in terms of profits and employment are Mongolia and Afghanistan, despite widely varying number of COVID-19 infections in each country, indicating that there are more factors at play.

World manufacturing output remains weak, with demand still depressed as a result of the COVID-19-induced crisis. UNIDO’s seasonally adjusted Index of Industrial Production (IIP) shows that manufacturing value added across 49 countries representing around 87 per cent of world manufacturing value added was down 20 per cent on average in April compared to December 2019.

All countries and industries have been affected, with significant impact from the fall in output felt in both lower and upper-middle income economies. The UNIDO analysis also notes that overall economic losses depend on the severity of containment measures and direct impact rather than on the direct health impact of COVID-19.

The UNIDO report calls on governments to tailor their responses to deal with country and sector specific problems. “How developing countries tailor these measures today will affect their prospects for building resilient, inclusive and sustainable post-crisis industrialization in the future. China, Europe and the United States have already initiated aggressive plans to reignite and bolster their productive capabilities and innovation. Developing countries must also seize the opportunity and start preparing now to prevent the existing asymmetries from widening even further.”

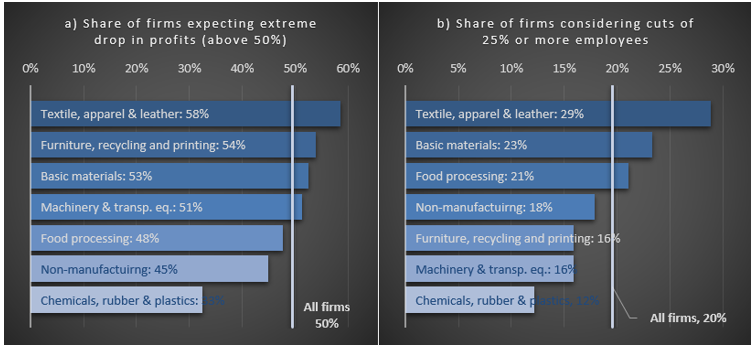

Among the firms contacted for the survey, results varied widely across sectors, with textiles, apparel and leather industries anticipating the largest plunge in profits and jobs, while firms in the chemical, plastic and rubber industries expect below average decreases.

Note: Expected impact of COVID-19 on firms’ profits and employment, by industry

The basic materials industries also expect profits and employment to be hit hard. In the furniture, recycling and printing industries, 54 per cent of firms are anticipating a serious decline in profits, but only 16 per cent expect that they will be forced to announce drastic job cuts, below the average share of firms included in the survey. Similar trends were seen in the machinery and transport equipment industries.

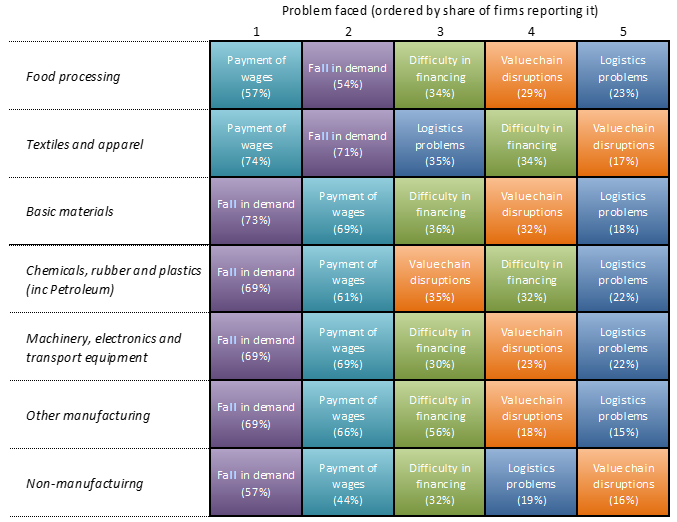

The different expectations across firms arise from the particular challenges they are facing, although a drop in demand is a widespread concern.

Note: The values in brackets indicate the share of firms in the industry that reported this particular problem.

In labour-intensive industries (such as textiles and apparel) the greatest hurdle, aside from falling demand, is the payment of wages. Firms in the textile and apparel industry are also particularly worried about logistics problems, while supply chain disruptions are more of a concern for firms in the chemical, rubber and plastic industries than for other industries.

Size matters

Small firms are overall gloomier about prospects, expecting a much larger drop in jobs and profits, although micro firms expect to slash fewer jobs than small and medium-sized (SMEs) firms, according to the UNIDO survey. Payment of wages is a much bigger problem for them too, whereas supply chains disruptions are more pressing for larger companies.

Note: Bars according to firm size. Only manufacturing firms are considered.

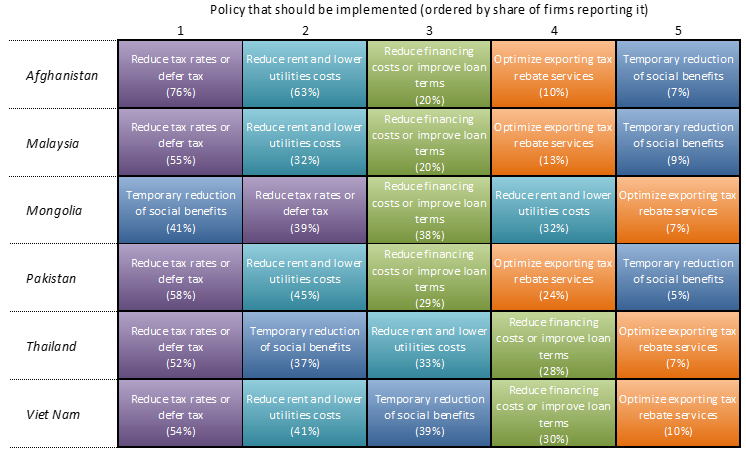

The most common policy responses across countries are tax and loan deferrals. The vast majority of firms surveyed said they would welcome reductions in taxes and rent or utility costs.

In relation to the fiscal response from governments firms said that direct financial support was most beneficial, which is in line with findings from a recent OECD analysis showing wage payments to be the most effective measure while tax deferrals were seen as least effective.

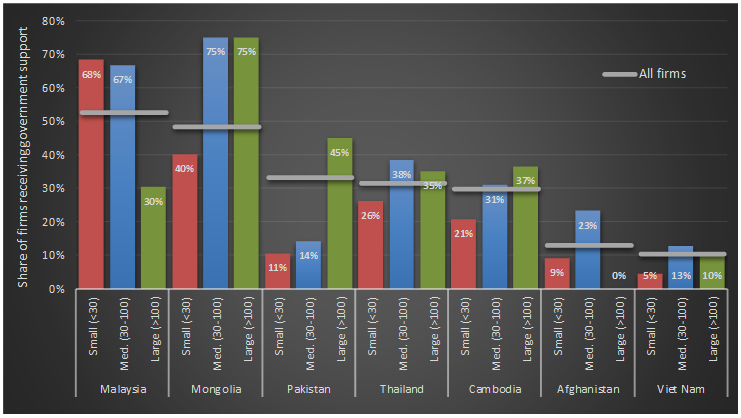

The report also looked at the level of support currently provided to firms, finding wide variations in policy responses. For example, in Afghanistan and Viet Nam, the average share of firms benefitting from government packages was 10 per cent, compared with 50 per cent in Malaysia and Mongolia.

It also showed that large firms were more likely to receive help than small and more vulnerable ones, with the exception of Malaysia where 70 per cent of small firms got some form of support.

Note: Share of firms benefitting from government support by firm size (%)

The report said that despite the efforts mobilized so far to support countries, especially in developing countries, the limited support for SMEs was worrying.

“The fact that SMEs are less likely to receive government support—in line with the fact that they generally face more obstacles in access to finance—serves as a warning sign and calls for improved policy responses to address the additional problems such firms are dealing with due to COVID-19,” UNIDO said, adding that the development of policy measures should be tightly monitored to direct policy.

See the full report: Coronavirus: the economic impact – 10 July 2020

* The UNIDO survey included seven countries and collected a total of 1,040 valid responses. It was implemented online between mid-April and early June in collaboration with governments, business chambers and other agencies operating in the participating countries: Afghanistan, Cambodia, Malaysia, Mongolia, Pakistan, Thailand and Viet Nam.