Will COVID-19 accelerate the transition to a sustainable fashion industry?

09 October 2020 UNIDO

By Marco Ricchetti and Roberta De Palma

The COVID-19 pandemic and the resulting economic shutdowns have created unprecedented challenges for the fashion industry, including declining consumer spending and disrupted supply chains. This situation may accelerate the shift to greener, more sustainable supply chains, which will not only be decisive for businesses, but also impact the future of the fashion industry as a whole.

In 2019, McKinsey identified sustainability as one of the key priorities for the fashion industry. Improving the sourcing of raw materials with better recycling processes, reducing water consumption, and substituting hazardous chemicals with safer alternatives, are among the measures that can cut the environmental footprint of fashion and help the industry to survive in the new business scenario.

Read related story - Sustainable fashion: UNIDO and Nudie Jeans to recycle second-quality jeans in Tunisia

The economic value of the fashion industry

For this article, the term “fashion industry” includes a variety of stakeholders along the value chain and refers to the production of clothing, leather and footwear made from textiles and related goods, and extending from the production of raw materials and the design and manufacturing of garments, textile and leather, accessories and footwear, to their distribution, consumption and disposal (UN Alliance for Sustainable Fashion, May 2020). The fashion industry business model is principally driven by the seasonality of fashion goods, and this has steered production and affected the life cycle of fashion goods over decades.

The fashion industry has created one of the largest consumer goods markets, with highly sophisticated value chains of significant economic importance. Worldwide, household purchases of fashion goods may be estimated at US$1.7bn at 2018 consumer prices, based on data from the OECD and UNStat. In OECD countries, where detailed figures are available, fashion is the second largest market for consumer goods after food and drinks.

Moreover, the fashion industry plays a central role in the creation of income and jobs, employing over 60 million people worldwide, and in some countries, the sector is a vital contributor to national industrial output and domestic value added.

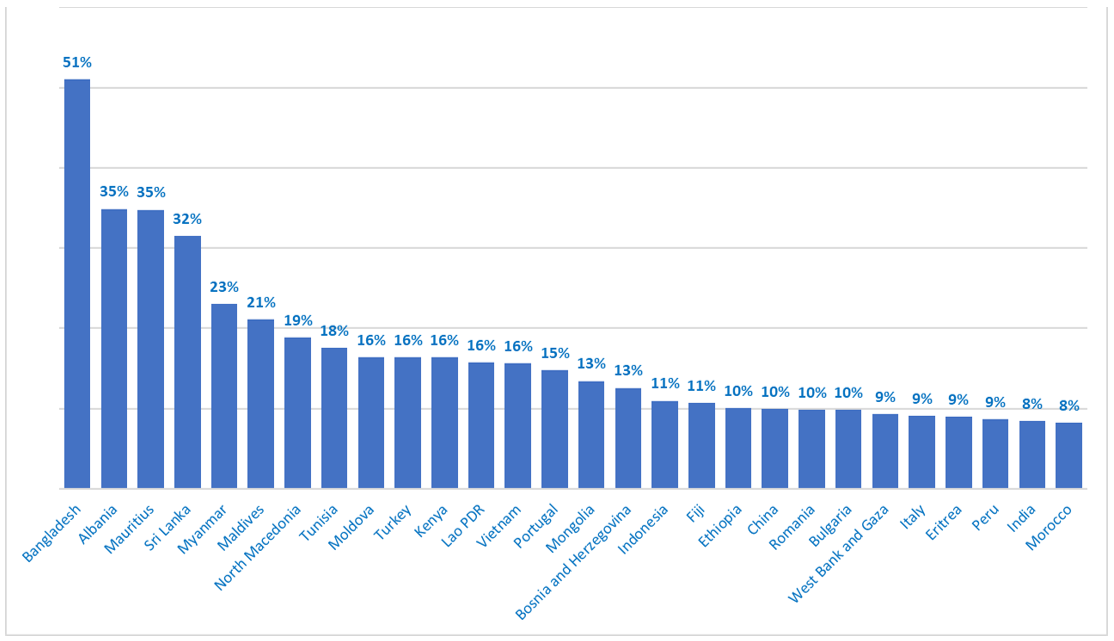

The share of textile and clothing in manufacturing value added is very high in several countries.

Textile and clothing industry share of national manufacturing value added, 2017

Source: World Bank, World Development Indicators

The environmental impact of the fashion industry

It follows that such a large industry has an enormous impact on the environment, and the fashion industry is thought to be one of the most polluting industries in the world. Besides the high water and carbon footprint, the sector makes intensive use of chemicals that are not only hazardous to the environment and humans, but also represent a major obstacle to textile recycling by contaminating purer recyclates. Rising global demand for textiles for various end user applications has made natural fibers increasingly scarce and a critical cost factor. In response to sustainability challenges, and spurred also by growing consumer awareness of the impact of garment production, global brands are seeking better alternatives, including renewable and recycled fibers, cleaner production processes and circular business models.

One of the aspects central to the implementation of circular economy practices in the fashion industry is related to raw material consumption. The manufacturing of garments generates huge amounts of textile waste along the supply chain. A study by Reverse Resources shows that more than 25% of materials - and sometimes as much as 47% - are discarded in fabric and garment factories.

Recycling and the valorization of textile waste generated during manufacturing is best done locally. International “trade of rags” is convenient but only if no efficient local recycling value chain is available, and is then a preferred alternative to land-filling or incineration. Exporting textile waste for recycling abroad is an unsustainable practice due to the transportation costs and associated CO2 emissions. It is also a missed opportunity for developing the local economy and closing the loop for materials in the textile producing countries. This is more pronounced in countries where recycling value chains are currently inefficient, poorly organized and confined to the informal economy.

The shift towards sustainability

In recent years, fashion brands and apparel manufacturers have accelerated their commitment towards environmental sustainability, especially in relation to the elimination of hazardous chemicals, the reduction of CO2 emissions, and, lately, also in the adoption of circular economy practices. The global COVID-19 outbreak revealed the vulnerability of global supply chains as countries restricted international trade, supply chain logistics were disrupted, and orders were cancelled due to suddenly diminishing demand. The new business scenario is forcing the whole industry to review strategies and plans.

There is still a risk that sustainability will drop off agendas in the fashion industry, as brands focus on survival, aiming to protect people, cash and liquidity; however, these times may also present an opportunity for companies that have not yet made sustainability a priority, to make the transition now (see BCG, SAC and Higg Co. Report, April 2020).

Evidence of the potential positive impact of the COVID-19 pandemic on the market for sustainable fashion comes from Zalando, the European online fashion platform. Zalando reported more customers are opting for sustainable fashion than in the past, increasing to almost 30% of its total customers in March 2020 (Zalando, 2020; Ecotextile News, May 2020).

The impact of the COVID-19 crisis

The COVID-19 pandemic created a dramatic contraction in demand and production. The fashion industry has been among those sectors more severely hit by the crisis, which is expected to gradually unfold in three waves.

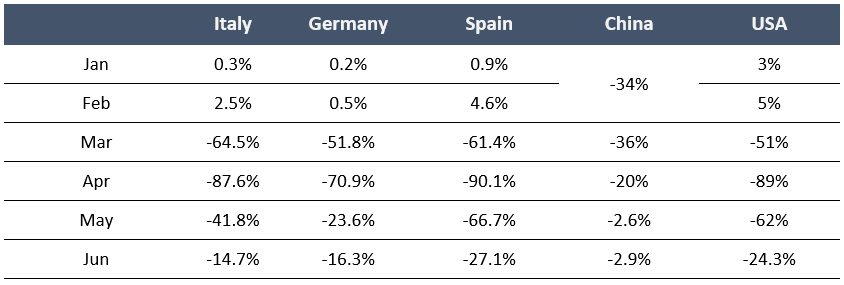

The first wave already hit the sector as fashion brands and retailers experienced a sudden drop in demand. Consumer purchases in retail stores recorded a deep fall in March, April and May that was not compensated by the growth of e-commerce in the same period. This scenario heralded a negative outcome for the whole Spring-Summer 2020 fashion season. This already claimed some victims among large retailers, especially in the United States, with True Religion Apparel, J. Crew, Centric Brands, Neiman Marcus, Aldo and others filing for bankruptcy.

COVID-19 impact on the 2020 Spring-Summer sales season in key countries. Retail sales of clothing and accessories monthly Y/Y % change, 2020

Source: Our calculations based on Eurostat, US Census Bureau, China NBSB

A similar shock hit suppliers all over the world with the cancellation of orders, even of completed or near-complete orders by buyers. In Bangladesh alone, US$1.5bn worth of orders were scrapped in March). Many manufacturers are now struggling with liquidity shortages and paying employees, leading to layoffs and factory closures. For instance, after western clothing brands’ cancelled or suspended £2.4bn of orders, over a million Bangladeshi garment workers either lost their jobs or were furloughed without pay.

It is a challenging landscape for businesses in the fashion sector, a matter either of surviving or vanishing in a very competitive market. It is not about preparing for a bleak future; it is about surviving now. The short-term impact can be transient or evolve into a permanent supply chain disruption and a loss of production capacities. Avoiding disruption will require strong support measures by national governments and some commitment from brands and retailers to protect their suppliers, for instance by limiting the cancellation of orders.

The second wave is expected by the end of 2020, affecting the winter season sales, and in 2021 when the next Summer-Spring season will enter the stores. Most of the already cancelled orders were for the 2020-21 Winter season. Brands operating within the traditional two season calendar give orders to suppliers in February-March for manufacturing in March to June and delivery to stores at between the end of July and mid-August. The lockdown and travel limitations stopped or slowed down production for the Fall-Winter 2020/21 season in many countries and can impact the availability of products in stores in September 2020.

As for the Summer-Spring 2021 season, new collections have not appeared at trade fairs and fashion weeks in July-September 2020. Trade fairs and fashion weeks have been cancelled or postponed. Brands are moving into uncharted territory, which demands new business models and new approaches to design, sourcing and manufacturing.

The third wave is related to the crisis of the entire fashion value chain as a result of the existing economic and environmental shortcomings of the business model, which have been amplified by the impact of the COVID-19 crisis. If no action is taken, the impact of the third wave will have long-term consequences for the whole industry. The word “crisis” comes from the ancient Greek “krisis” that means the decisive moment or the moment for decision. The COVID-19 emergency can act as an accelerator for decisions for change that are long overdue in the fashion industry and can no longer be deferred.

There are also multiple and interconnected drivers in the business environment that require major changes in the way textile value chains operate on a global and local level.

The COVID-19 crisis has shed light on the risks of relying exclusively on long global supply chains. Proximity to consumer markets, near-shoring and “safe shoring” can be a business risk reduction strategy, while it is also a strategy that can make a customer-centred supply chain more resilient to disruptions. As for the European market, a Global Value Chains Diagnostic Study from the European Bank for Reconstruction and Development highlights that four countries in the Mediterranean region, Morocco Tunisia, Jordan and Egypt, have high comparative advantage in exports of textiles and garments, and could benefit from diversification and recalibration of global value chains, in particular in the post COVID-19 context.

Reducing the size and geographical concentration of orders can help to ensure the stability of the supply chain. We expect larger brands to manage their supply chain disruption risks in the future by placing more value on stable business-to-business relationships, certifications about workers’ safety, and environmental sustainability practices, rather than depending only on price in the selection of a supplier.

The fashion industry can take advantage of the existing drivers in the business environment when either embarking on the sustainability journey or, if already committed, take it to the next level. In the context of COVID-19, it is not a choice between economic sustainability or environmental sustainability. The shift to more sustainable business models and supply chain management is an essential step for businesses to survive.

Shifting towards a circular model: Support from public policy institutions

European governments in particular are taking exceptional financial measures to support a post-COVID-19 green economic recovery. This recovery will also contribute to shaping the fashion industry’s development over the next decade. It is an extraordinary opportunity to take a significant step towards a more sustainable future. The European Union has clear plans in this direction. Vice-President of the European Commission, Frans Timmermans, emphasized that “every Euro” spent on economic recovery measures would be linked to the green and digital transitions and that, “every Euro we invest must flow into a new economy rather than old structures.”

The green recovery principle is also embedded in the international cooperation of the EU and is a core pillar of the technical cooperation programme of the United Nations Industrial Development Organization (UNIDO) in developing countries.

As part of the European Green Deal, the Commission has outlined a set of measures that could become legally binding and aim to prioritize energy efficiency, as well as circular economy practices in the fashion industry. The Green Deal can only succeed if the situation for producing and exporting countries can be improved and cooperation with local governments can be developed to enable the adoption of better production models for the fashion industry. Considering that the largest and most polluting part of the fashion industry is located in developing economies, UNIDO can play an important role in accelerating the engagement of the local textile actors in these countries.

The SwitchMed Programme

In 2019, the EU-funded SwitchMed Programme led by UNIDO launched an initiative with a special focus on the textile supply chains in Egypt, Morocco and Tunisia. Together with international brands and key expert organizations, UNIDO engages national stakeholders in the development of greener and circular value chains. The SwitchMed Programme has two main objectives:

Improving the environmental performance of the global fashion industry will require support for actors along the value chain, especially in the producing nations, to help develop knowledge, capacities and solutions, as well as creating business linkages across the value chain for circular solutions. Higher levels of circularity along local value chains can also contribute to new jobs, add value to the local economy and prepare local industries to meet future global market requirements for sustainably produced fashion products. To accelerate the implementation of safer chemical protocols along the value chain, UNIDO signed a collaboration with the ZDHC Foundation, the global platform for safer chemicals in the textile and leather sector, to create national capacities and document the business case for better chemical use within the sector.

The COVID-19 pandemic has challenged the fashion industry and the industry’s response will shape the future supply chain. Actions to ensure long-term sustainability will strengthen the resilience of businesses along the supply chain. Investing in more sustainable production methods could therefore become decisive for producers in the fashion industry to strengthen their role in the supply chain and improve strategic partnerships with global brands.